Cash sales decreased in July, following the trend back down to pre-crisis levels, according to a new report from CoreLogic.

Cash sales made up 29.7% of total home sales in July. This is down 1.9 percentage points from July 2015, but up slightly from June’s 29.3%. The cash sales share peaked in January 2011 at 46.6% of total home sales, but the pre-crisis average stands at 25%.

If the cash sales share continues to decrease at its current rate, it could hit pre-crisis levels by mid-2018.

REO sales hold the largest share of cash sales with 57.6%. Resales had the next highest share at 29.4%, followed by short sales at 28.1% and newly constructed homes at 15%.

While REO holds the largest share of cash sales, the amount of cash sales in the market have declined since the peak in 2011. In fact, REO sales decreased to the lowest share in the market since July 2007 at 4.3%.

Distressed sales also hit a low at 7.2%, the lowest number of distressed sales since September 2007. This is down from the January 2009 peak of 32.4% of all sales. The pre-crisis share of distressed sales averaged 2%. The distressed sales rate is also expected to hit pre-crisis levels by mid-2018.

The decrease in distressed sales led to foreclosure activity dipping to its lowest point since before the foreclosure crisis, according to the September and Q3 2016 U.S. Foreclosure Market Report released by ATTOM Data Solutions, the new parent company of RealtyTrac.

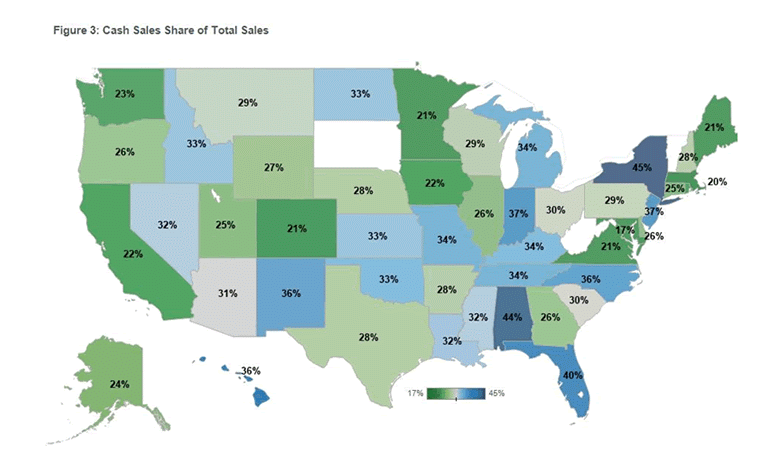

Click to Enlarge

(Source: CoreLogic)

Maryland held the largest share of distressed sales out of any state with 19.4%, followed by Connecticut with 18.6%, Michigan with 17.8%, New Jersey with 15.6% and Illinois with 15.5%.

On the other hand, North Dakota had the smallest amount of distressed sales at 2.5%.

Click to Enlarge

(Source: CoreLogic)