June’s S&P CoreLogic Case-Shiller U.S. National Home Price Index showed home prices increased 5.8% annually, and experts explained this increase is the largest jump in the past three years.

Experts explained that, unsurprisingly, this increase is due to the low levels of housing inventory. One expert also predicted home prices will continue to increase throughout 2017, but explained why the market is not on the verge of seeing its next home price boom.

“The 5.8% annual gain in house prices reported by Case-Shiller in June was the highest in three-years, as a shortage of inventory boosted prices even as active housing demand has edged back,” Capital Economics Property Economist Matthew Pointon said. “Tight market conditions will drive house prices higher over the remainder of the year, although cautious appraisals and tougher mortgage lending regulations will act to prevent a dangerous house price boom.”

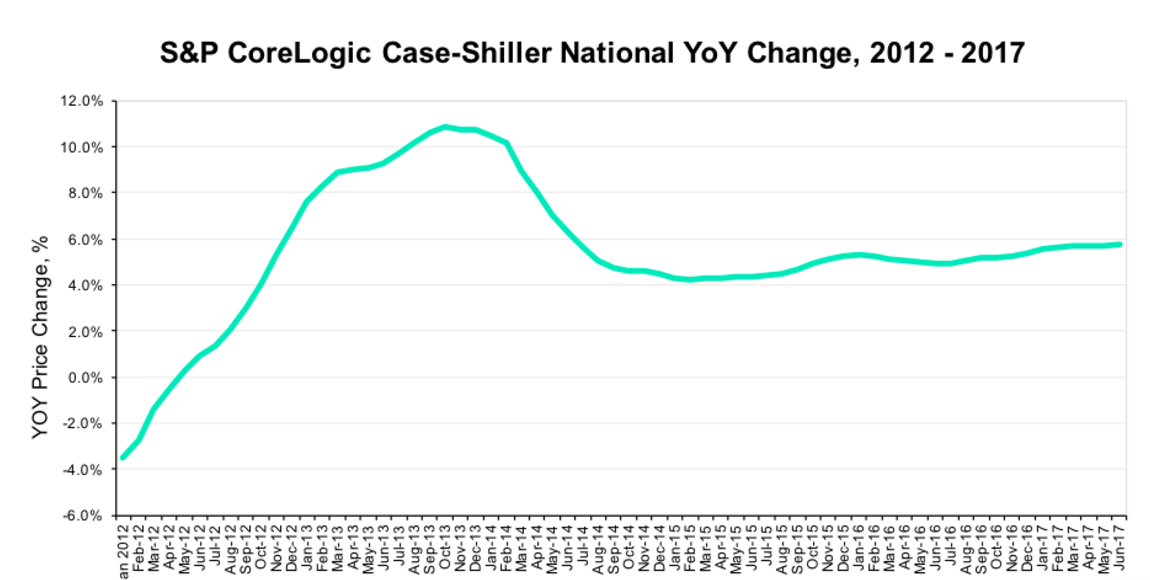

The chart below from Trulia shows the percentage of annual change each month dating back to January 2012. It shows the annual increase continues to trend slightly higher each month.

Click to Enlarge

(Source: Trulia)

One expert explained these increasing prices and high demand represent a new normal for the housing market.

“It’s a new normal in the housing market,” Trulia Senior Economist Cheryl Young said. “Ever rising prices being met by insatiable demand. Demand remains unimpeded by exceptionally low inventory as homebuyers enjoyed strong job growth and low mortgage rates, driving prices ever higher.”

And she agreed increasing home prices are not likely to let up any time soon, warning homebuyers to be on the lookout for yet another month of increases.

“Prospective homebuyer frustrations are sure to mount with another month of year-over-year increases in home prices as the Case-Shiller index rose 5.8% in June over last year,” Young said.

Monday, a new report from First American Financial Corp. showed that while home prices continue to increase, housing became more affordable in June due to rising wages and falling interest rates.