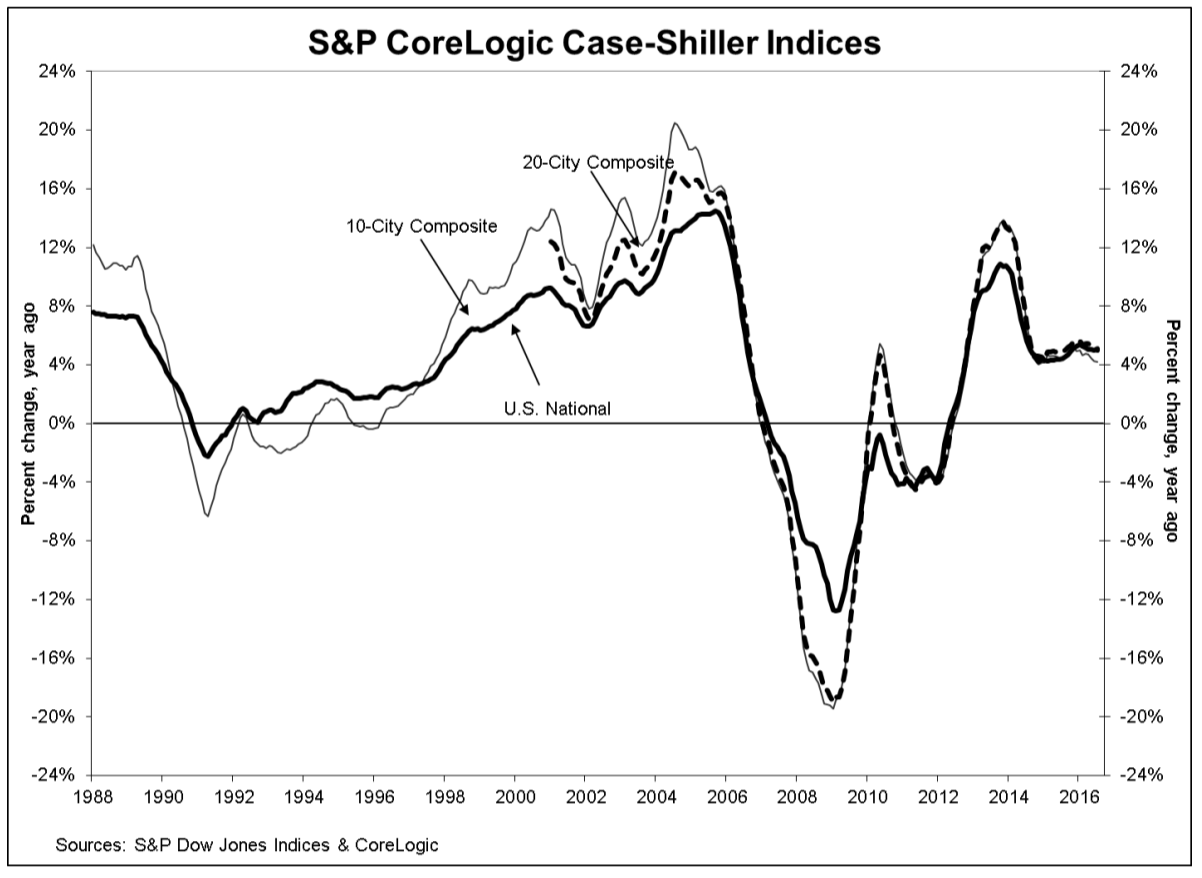

Home prices continued their increasing trends continued to increase in July, but at a slower rate than before, according to the most recent report by S&P CoreLogic Case-Shiller Indices released by S&P Dow Jones Indices and CoreLogic.

“The S&P CoreLogic Case-Shiller National Index is within 0.6% of the record high set in July 2006,” said David Blitzer, S&P Dow Jones Indices managing director and chairman of the Index Committee. “Seven of the 20 cities have already set new record highs.”

“The 10-year, 20-year, and National indices have been rising at about 5% per year over the last 24 months,” Blitzer said. “Eight of the cities are seeing prices up 6% or more in the last year. Given that the overall inflation is a bit below 2%, the pace is probably not sustainable over the long term.”

Annually, the National Home Price index showed a gain of 5% in July. This is down slightly from June’s 5.1% annual gain. The 10-City Composite increased by 4.2% annually and the 20-City Composite increased by 5%. Each of these is down from June’s 4.3% and 5.1% for the respective composites.

Click to Enlarge

(Source: S&P Dow Jones Indices, CoreLogic)

“Both the housing sector and the economy continue to expand with home prices continuing to rise at about a 5% annual rate,” Blitzer said. “The statement issued last week by the Fed after its policy meeting confirms the central bank’s view that the economy will see further gains.”

While the Federal Open Market Committee did not raise rates at their last meeting, Janet Yellen, Federal Reserve System chair of the Board of Governors, explained, “Our decision does not reflect a lack of confidence in the economy.”

She explained the Fed preferred to take a more cautious approach to see if current growth would continue.

“Most analysts now expect the Fed to raise interest rates in December,” Blitzer said. “After such Fed action, mortgage rates would still be at historically low levels and would not be a major negative for house prices.”

Out of the 20 cities, Portland, Seattle and Denver reported the highest annual gains over the last six months. In July, Portland increased 12.4%, Seattle increased 11.2% and Denver increased 9.4%.

After seasonal price adjustment, the National Index increased by 0.4% monthly but the 10-City Composite decreased 0.1%. The 20-City Composite remained unchanged.

“The run-up to the financial crisis was marked with both rising home prices and rapid growth in mortgage debt,” Blitzer said. “Currently, outstanding mortgage debt on one-to-four family homes is 12.6% below the peak seen in the first quarter of 2008 and up less than 2% in the last four quarters. There is no reason to fear that another massive collapse is around the corner.”