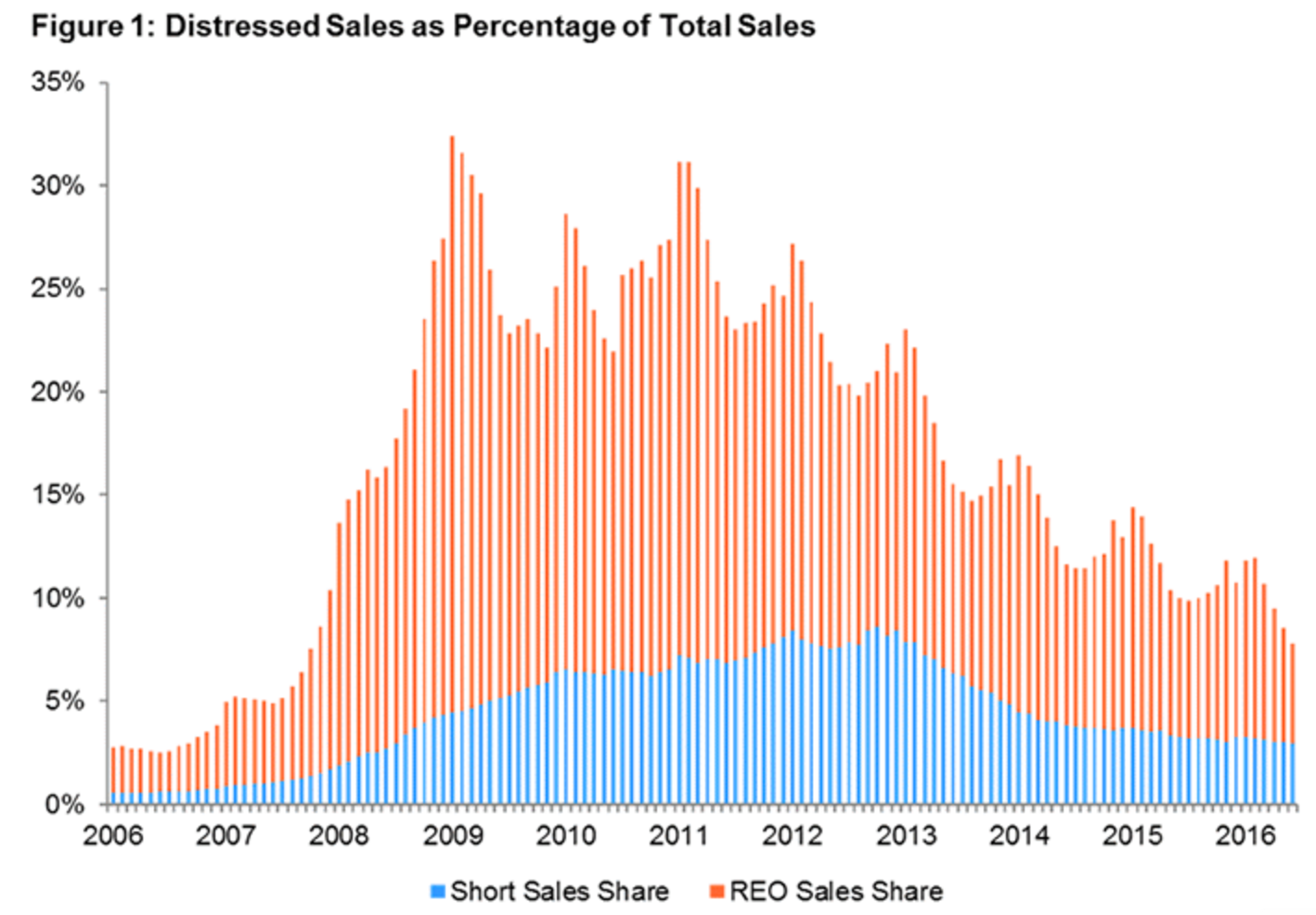

Distressed sales slipped down in June by 2.2% from last year and 0.8% from May, according to the latest report from CoreLogic.

Within the distressed category, real estate owned sales accounted for 4.9% of the distressed sales and 2.9% of total home sales in June. This is a decrease of 1.9% from June 2015, and is the lowest for any month since September 2007.

At its peak in January 2009, distressed sales accounted for 32.4% of market sales, and REOs accounted for 27.9% of distressed sales.

While distressed sales play an important role in clearing the housing market of foreclosed properties, they sell at a discount to non-distressed sales, and when the share of distressed sales is high, it can pull down the prices of non-distressed sales, according to CoreLogic. There will always be some level of distress in the housing market.

For comparison, the pre-crisis share of distressed sales was traditionally about 2%. If the current year-over-year decrease in the distressed sales share continues, it will reach that normal 2% mark in mid-2019.

This is consistent with last month’s prediction, however, two months ago, CoreLogic predicted that sales would hit the pre-crisis market by mid-2017, a two-year difference from its current prediction.

Eight states still showed an increase in distressed sales from last year. Maryland held the largest share of distressed sales with 19.4%, followed by Connecticut with 18.4%, Michigan with 17.6%, Illinois with 15.8% and New Jersey with 15.3%.

Once again, North Dakota had the smallest distressed sales share at 2.5%. Florida had the largest decline of any state with a drop of 5.8 percentage points from last year. California had the largest improvement of any state from its peak share. It fell 60.6 percentage points from its 2009 peak of 67.5%.

Click to Enlarge

(Source: CoreLogic)