Home prices continued to increase in June 2017, even inflating some markets until they became overheated, according to the Home Price Index and HPI Forecast from CoreLogic, the property information and analytics provider.

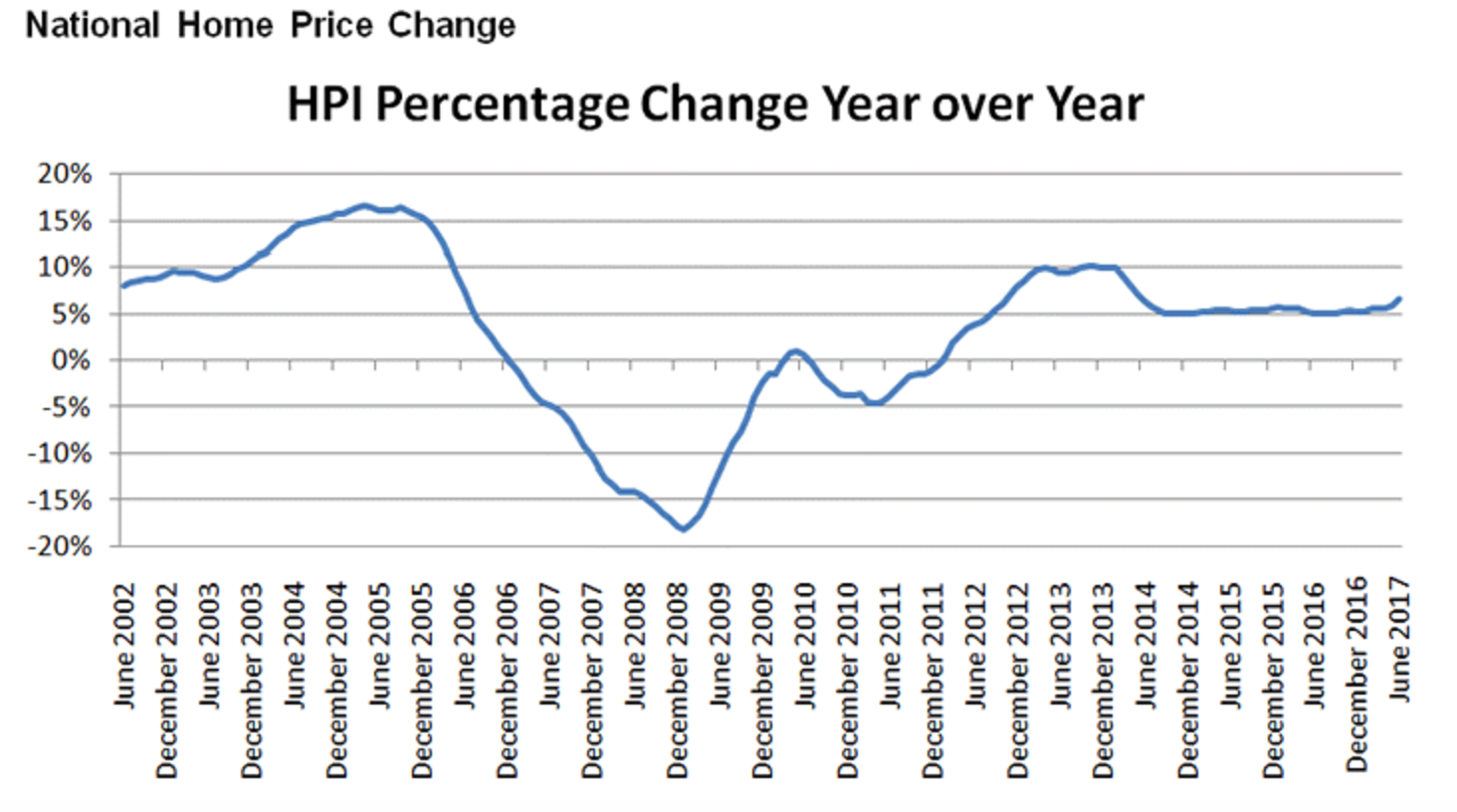

The report notes home prices increased 6.7% from June 2016 to June 2017 and increased 1.1% from the last month, the HPI showed.

Click to Enlarge

(Source: CoreLogic)

And CoreLogic’s forecast shows home prices will only continue to rise. Home prices will increase 5.2% by June 2018 and 0.6% by July, according to the forecast.

The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The growth in sales is slowing down, and this is not due to lack of affordability, but rather a lack of inventory,” CoreLogic Chief Economist Frank Nothaft said. “As of Q2 2017, the unsold inventory as a share of all households is 1.9%, which is the lowest Q2 reading in over 30 years.”

Home prices are rising so quickly, in fact, that of the nation’s 10 largest metropolitan areas measured by population, four were considered overvalued in June, CoreLogic’s Market Conditions Indicators data showed.

The four overheated markets named are Denver, Houston, Miami and Washington, D.C.

By comparing home prices to their long-run, sustainable levels, which are supported by local market fundamentals such as disposable income, the MCI categorizes home prices in individual markets as undervalued, at value or overvalued. Because most homeowners use their income to pay for home mortgages, there is an established relationship between income levels and home prices.

The MCI defines an overvalued market as one in which home prices are at least 10% higher than the long-term, sustainable level, while an undervalued market is one in which home prices are at least 10% below the sustainable level.

“Home prices are marching ever higher, up almost 50% since the trough in March 2011,” CoreLogic President and CEO Frank Martell said. “With no end to the escalation in sight, affordability is rapidly deteriorating nationally and especially in some key markets such as Denver, Houston, Miami and Washington.”

“While low mortgage rates are keeping the market affordable from a monthly payment perspective, affordability will likely become a much bigger challenge in the years ahead until the industry resolves the housing supply challenge,” Martell said.

The most recent Case-Shiller results pointed out the housing market is growing more expensive, however it is not about to repeat the bubble years.