The last full day of the Mortgage Bankers Association annual conference is underway, and the latest revelation is increasing home prices may not be as threatening as many think.

Many studies, including today’s S&P CoreLogic Case-Shiller Home Price Index, show that home prices gains are up more than 5% nationally. While that’s true, the story changes when economists bring in other factors.

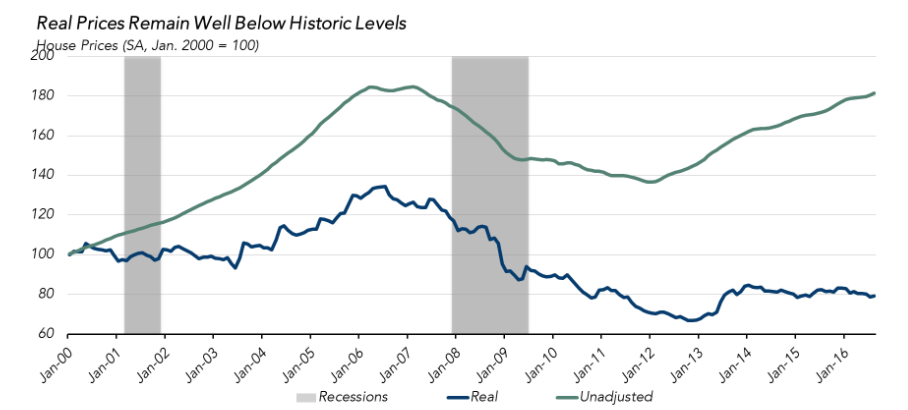

In fact, when adjusting for inflation and the amount of purchase power provided by low interest rates, home prices actually dropped in the past 16 years, First American Chief Economist Mark Fleming said in an interview with HousingWire.

“Contrary to popular opinion, housing isn’t getting more expensive,” Fleming said. “In fact, on a purchasing-power adjusted basis, housing is becoming more affordable.”

“Interest rate declines, combined with meaningful gains in incomes, have provided the consumer with greater buying power, which increases housing affordability,” he said. “The growth in consumer house-buying power is actually outpacing the increases in nominal prices driven by remarkably tight inventories.”

The amount of purchasing power is determined by many economic factors including interest rates, inflation and household income.

Since July 2006, real home prices decreased 41% as of August. They did, however, increase 0.8% from July, but decreased 2.6% from August 2015. Real home prices decreased 20.7% from January 2000.

This chart shows that while home prices are near housing boom peaks, affordability is actually much better off:

Click to Enlarge

(Source: Standard & Poors, First American)

“At the moment, affordability is actually increasing in more markets than it is decreasing, including San Francisco, San Jose, New York, Washington and Boston,” Fleming said. “The conventional wisdom that these markets are over-valued does not account for the meaningful growth in consumer house-buying power across the majority of major metropolitan markets.”

However, an increase in interest rates could decrease the demand for housing and put the brakes on rising home prices, Fleming told HousingWire. It would decrease the buying power of consumers.

And yet, MBA Chief Economist Mike Fratantoni still predicts double-digit increases in purchase mortgage originations in 2017, despite the possibility of a rate hike.

While a decrease in interest rates could also mean a decrease in purchasing power, according to Fleming it’s “not necessarily a bad thing.”

The economy can’t sustain a prolonged period of low interest rates, he said.

Several members of the Federal Open Market Committee agree with this view, and continue to argue for a rate hike. Many experts expect the Fed to raise interest rates in December.