The National Association of Realtors reported existing home sales decreased 1.3% to its lowest level in a year, a move that economist said while disappointing, was not unexpected.

One economist explained this low level of home sales since last year as it struggles against low inventory levels.

“Today’s existing home sales data was disappointing, if unsurprising, and the decline in sales in July was compounded by downward revisions to June sales,” Zillow Senior Economist Aaron Terrazas said. “The American housing market is stuck in its own kind of stagflation: Existing home sales have been flat since last fall, while home values are up more than 4% over the same period.”

One economist said the second half of 2017 will see gains in existing home sales, however it could be brought down by low housing inventory.

“The fundamentals of housing demand remain strong, led by solid job gains, faster household formations, and low mortgage rates,” Nationwide Senior Economist Benjamin Ayers said. “These suggest that existing home sales should move higher as the year progresses, although actual sales will likely be held back by the lack of inventory.”

“Under more normal demand/supply conditions, existing home sales would be expected to rise sharply during the second half of 2017 – but in the current tight market, the actual gains are expected to be more modest,” Ayers said.

And other experts agreed the current home sales could become the new norm amid the low housing inventory market.

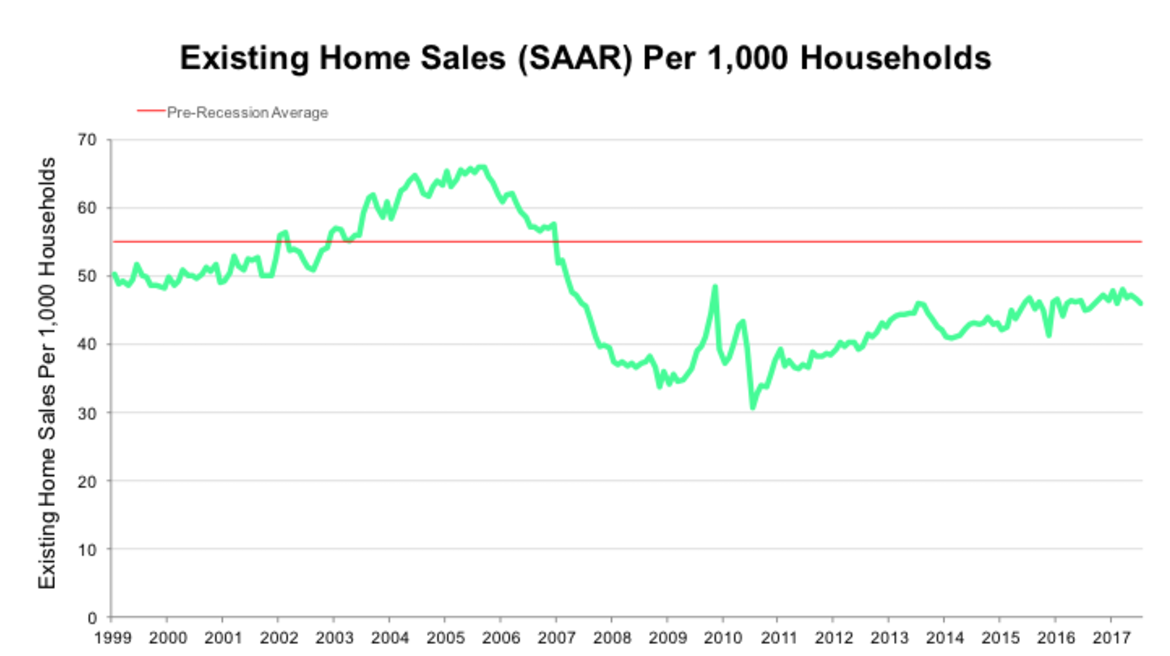

“Existing home sales still fell below the pre-recession norm, taking into account the U.S. population, and reached just 83.5% of normal in July,” Trulia Senior Economist Cheryl Young said. “Expect this rate remain below normal as first-time and younger home buyers struggle to gain a foothold in the housing market because of low supply.”

The chart below shows existing home sales dropped below the pre-recession average in 2007, and has yet to rise above it again.

Click to Enlarge

(Source: Trulia)

One expert pointed out homebuyer demand continues to be strong, despite rising home prices, a sign of health in the housing market.

“The bottom line is that there simply are not enough homes on the market to keep the overall pace growing each month,” realtor.com Chief Economist Danielle Hale said. “At the same time, continued buyer interest in the face of more than five years of price growth is a sign of strong demand and bodes well for the health of the housing market in the future.”

Other economists agreed, saying while low inventory is holding back sales, the housing demand continues to be strong.

“Though there has been steady economic growth and a strong demand for housing, we’ve seen a low inventory continuing to hold the market back,” said Bill Banfield, Quicken Loans executive vice president of capital markets. “These trends coupled with low rates make the market much more competitive for consumers to purchase a home.”