Foreclosure inventory in August declined significantly from last year, hitting its lowest point since the housing boom, according to the August 2016 National Foreclosure Report from CoreLogic, a property information, analytics and data-enabled solutions provider.

Foreclosure inventory decreased 29.6% while completed foreclosures decreased 42.4% to 37,000, down from last year’s 64,000, according to the report. This is down slightly from last month’s 38,000 completed foreclosures. The decrease is 69% less than its peak of 118,551 in September 2010.

The foreclosure inventory represents the number of homes at some stage of the foreclosure process while completed foreclosures reflect the total number of homes lost to foreclosure.

In August, the national foreclosure inventory hit 351,000, or 0.9% of all homes with a mortgage. This is down from 499,000, or 1.3%, in August 2015. This inventory is the lowest it’s been since July 2007.

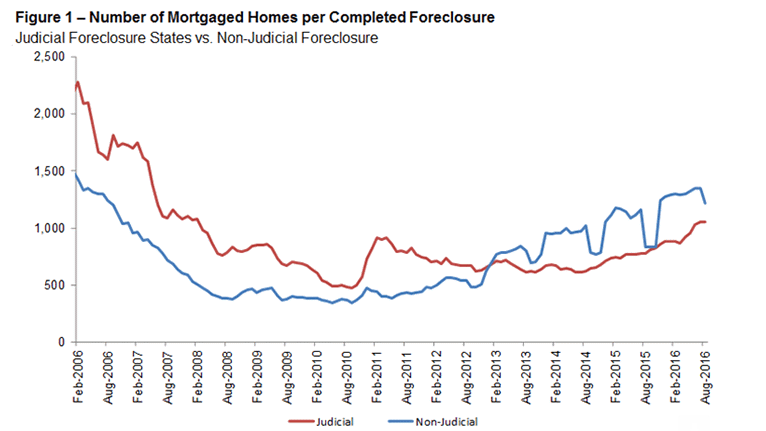

Click to Enlarge

(Source: CoreLogic)

“Foreclosure inventory fell by 30% from the previous year, the largest year-over-year decline since January 2015,” CoreLogic Chief Economist Frank Nothaft said.

“The large decline in the distressed inventory has been one of the drivers of steady home price growth which helps Americans increase their home equity to support increased spending or cushion future economic risk,” Nothaft said.

The number of mortgages in serious delinquency, mortgages that are 90 days or more past due including loans in foreclosure or real estate owned, saw a significant decrease of 20.6% from last year. At 1.1 million mortgages, or 2.8%, mortgages in serious delinquency hit its lowest point since Sept. 2007.

“Foreclosure rates and serious delinquency continued to trend down in August as real estate markets across many parts of the U.S. exhibit strong demand growth and rising prices,” CoreLogic President and CEO Anand Nallathambi said.

“With the foreclosure inventory now under 1% nationally, the need to boost single-family housing stocks through new construction will become more acute in the coming months and years,” Nallathambi said.

Because of this drop in foreclosures, banks are no longer in need of servicers, therefore banks cut these mortgage servicers by 50% in the past two years, according to the latest quarterly U.S. RMBS Servicer Handbook by Fitch Group, which deals in financial information services with operations in more than 30 countries.