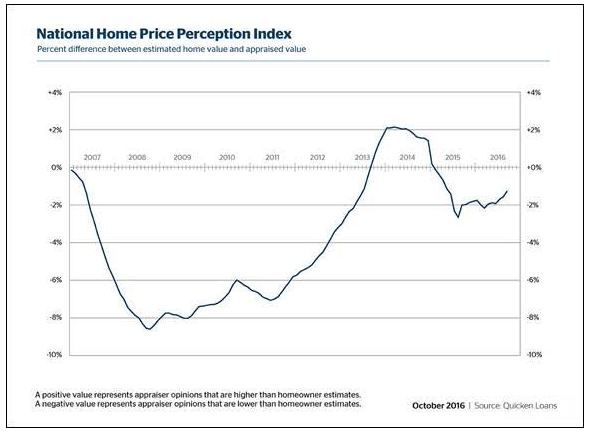

Homeowners are still placing too much value on their homes, but they are getting closer to the appraised value, according to the Home Price Perception Index released by Quicken Loans, a retail mortgage lender.

Homeowners’ estimates of their home prices came in 1.26% below the appraised values in September. This is a narrower gap from August’s 1.56%. This is the third month in a row that the HPPI moved closer to agreement between homeowners and appraisers.

Consumers are taking a more cautious approach to their view of the economy, according to the latest Fannie Mae Home Purchase Sentiment Index.

While average appraisal values fell 0.28% from August, they increased 7.78% from last year.

Click to Enlarge

(Source: Quicken Loans)

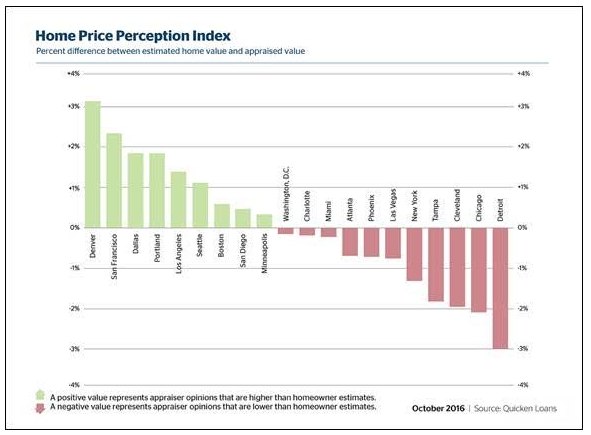

In some areas of the country, however, appraised home values actually came in higher than what homeowners estimated. Such markets include Denver, San Francisco and San Jose.

On the other hand, markets such as Philadelphia, Baltimore and Chicago appraised home prices came in significantly lower than what homeowners thought.

“When reading about the health of the economy, many consumers don’t take into account how varied housing markets can be,” Quicken Loans Chief Economist Bob Walters said.

“If a homeowner in Philadelphia hears about the housing boom out west, they could be surprised when their home doesn’t sell at the price they thought it would,” Walters said. “I encourage homeowners to work with real estate agents, lenders and other experts to determine their home’s value.”

Click to Enlarge

(Source: Quicken Loans)