You’ve always dreamed of buying that ski cabin or lake house, and you plan to afford it by renting it out when you’re not using it. Good plan, but lender rules don’t allow it. Here’s what you need to know.

Loan types and their rules

The first step in financing your dream getaway home is to understand the different mortgages available for the three different ways a home can be used:

- Primary residence loans. These loans are the most favorable. You can buy for as little as three percent down, and you’ll get the lowest possible mortgage rates. These loans require you to move into the home within 60 days of closing the loan, and live in the home for at least one year – after that, you’re free to rent out the home.

- Second home loans. These loans have the same rates as primary residences, so your rate will be the lowest it can be, but down payments must be larger: Most lenders require 20 percent down. You qualify for the loan using your full primary residence housing cost plus your full second home cost. You can use the home for family and friends, but lenders won’t let you rent the home.

- Non-owner occupied loans. Also called rental property loans, these loans offer rates .25 percent to .375 percent higher than primary residence or second home rates, and down payment requirements typically start at 30 percent. Your lender will let you know if you can use the rental income to qualify. These loans allow you to rent the home, and use the home when it’s not rented.

Beware second home loans

The best thing about a second home mortgage is that the rates are the same as a primary residence mortgage. The worst thing is that you can’t rent the home.

This is an often-overlooked provision of second home loans, but it’s the most important, because if you ever rent your vacation getaway, you will violate the terms of the loan.

When you get a loan, there is a document called the Note, which spells out loan amount, rate, payments, and fixed versus adjustable periods of your loan. Depending on what state you live in, you’ll also have either a mortgage or deed of trust in addition to your note, which spells out additional loan requirements you must comply with. (See which states use mortgages vs. deeds of trust.)

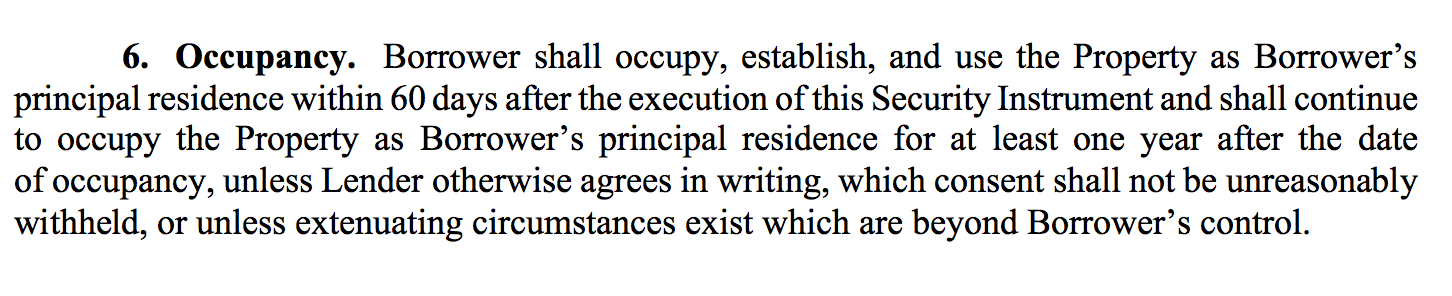

At first glance, a second home mortgage or deed of trust seems like it has the same requirements as a primary residence. Provision 6 says you must move in within 60 days and live there for at least one year – then you’re free to rent it out. Here’s a sample:

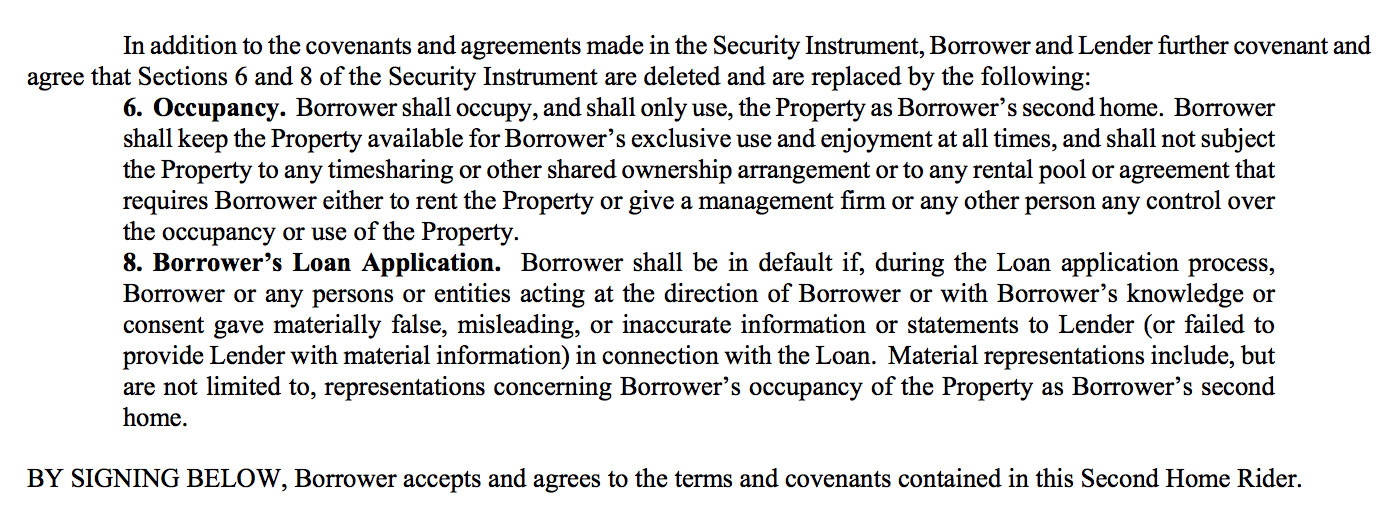

However, there’s an addendum – called a rider – in mortgages and deeds of trust that replaces this friendly requirement with a new, much more strict requirement saying you can’t rent out the home. Here’s a sample:

However, there’s an addendum – called a rider – in mortgages and deeds of trust that replaces this friendly requirement with a new, much more strict requirement saying you can’t rent out the home. Here’s a sample:

This language, though hidden deep in the loan documents you’ll sign before closing, makes two critical points:

- You can’t rent the home.

- If you applied for a second home loan and rent out the home, your entire loan balance could be called due and payable by your lender.

Choosing a loan

So if you plan to afford a home away from home by renting it out when you’re not using it, you cannot finance it with a second home loan.

Most people start with this premise because it’s tempting to save on down payment or rate. But you will need to review non-owner-occupied loan options with your lender to meet the objective of using and renting a home that’s not your primary residence.

As noted above, this means you’ll need to put down a larger down payment and your rate will be slightly higher. But it’s a small price to pay for the flexibility of earning income off of a home that you also use for your own enjoyment.

Related:

- Why You Should Buy Your Retirement Home Before You Retire

- 4 Steps to Buying a Second Home

- How to Own a Vacation Home With Friends

Note: The views and opinions expressed in this article are those of the author and do not necessarily reflect the opinion or position of Zillow.