Cash sales increased once again in September, but are still down from last year, according to a new report from CoreLogic.

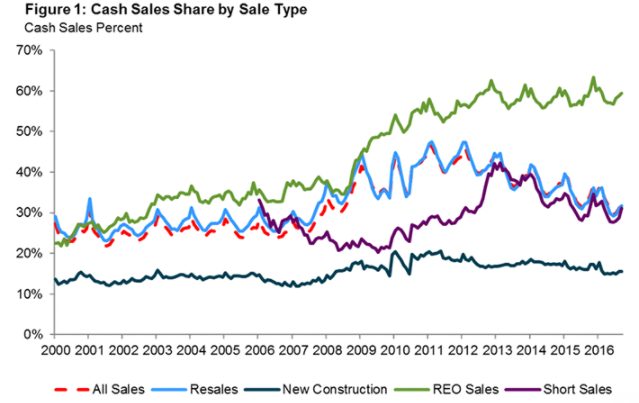

Cash sales made up 31.7% of total home sales in September, down 1.3% from last year, but up slightly from August’s 31.1%.

For comparison, cash sales peaked in January 2011 when they accounted for 46.6% of home sales. The pre-recession average held steady around 25%.

If cash sales continue to decrease at their current annual rate, the share could hit those pre-crisis levels by mid-2019.

Already, some studies show that cash sales may no longer hold the same weight for discounts that they did in the past.

As always, real estate owned sales held the largest cash sales share in September at 59.4%, followed by resales at 31.7%, short sales at 31.2% and newly constructed homes at 15.5%. While the share of cash sales within REO is high, resales make of the majority of market sales.

Click to Enlarge

(Source: CoreLogic)

Distressed sales, where REOs made up 4.7% of total home sales, while short sales made up 2.7%, fell to 7.3%, their lowest point since September 2007. At this rate, distressed sales could hit the pre-crisis 2% mark by mid-2018.

However, some states had distressed sales at much higher than the national average. Maryland had the largest share of distressed sales with 18.9%, while North Dakota had the smallest amount of distressed sales at 2.7%.

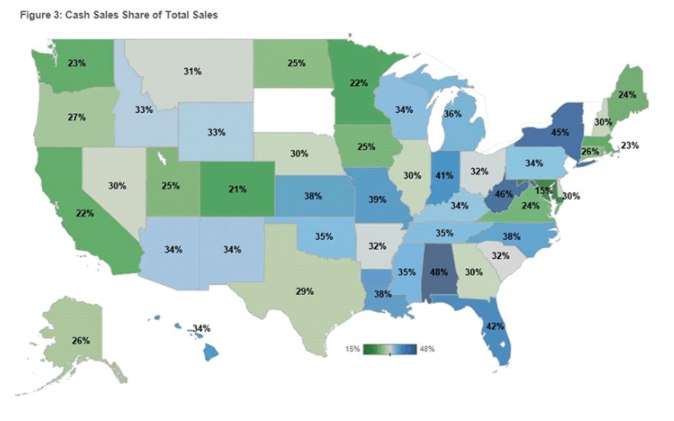

The cash sales share in some states was also much higher than the national average. Alabama had the highest share of cash sales at 47.6%, followed by West Virginia at 45.8%, New York at 45.3%, Florida at 41.6% and Indiana at 40.9%.

Click to Enlarge

(Source: CoreLogic)