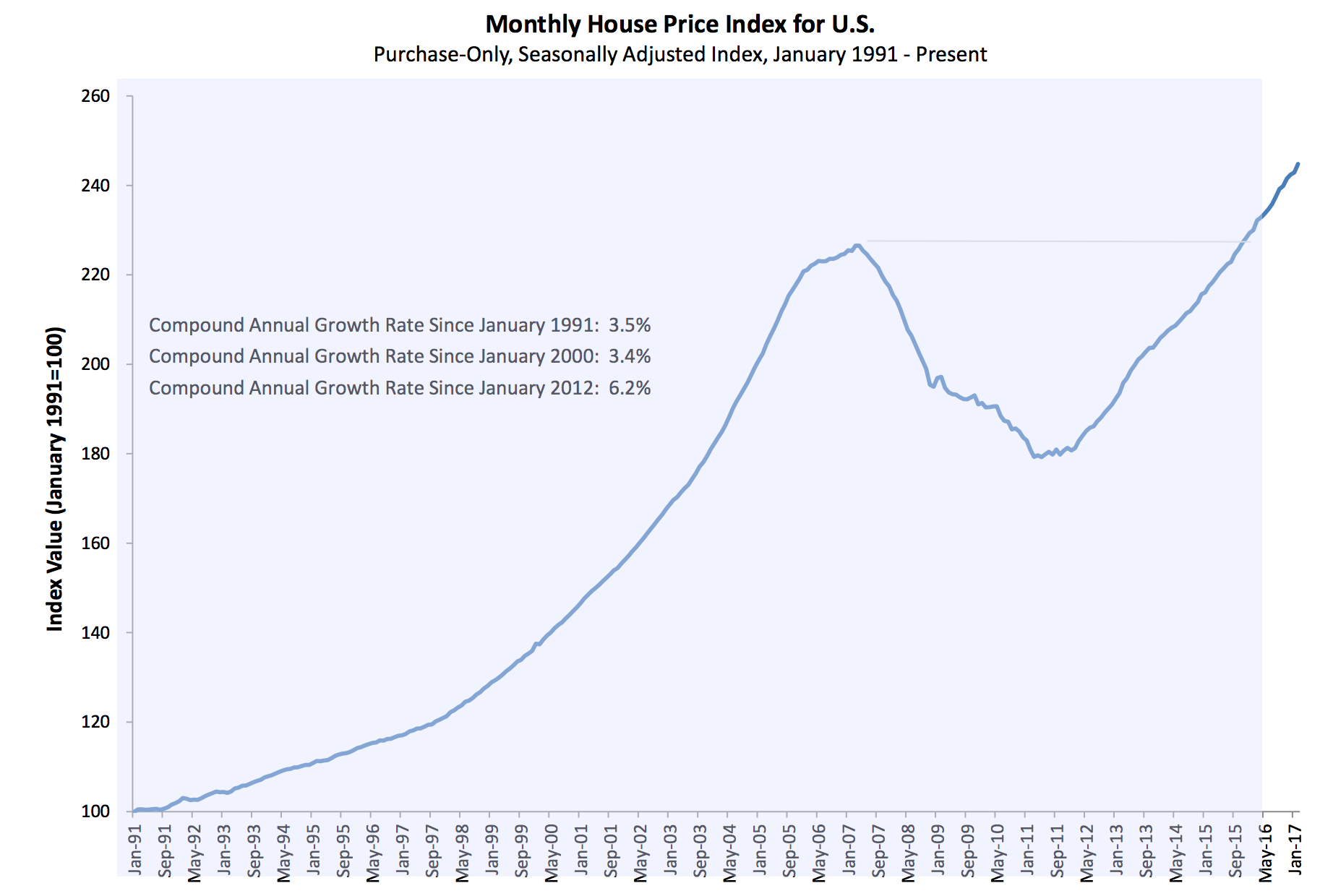

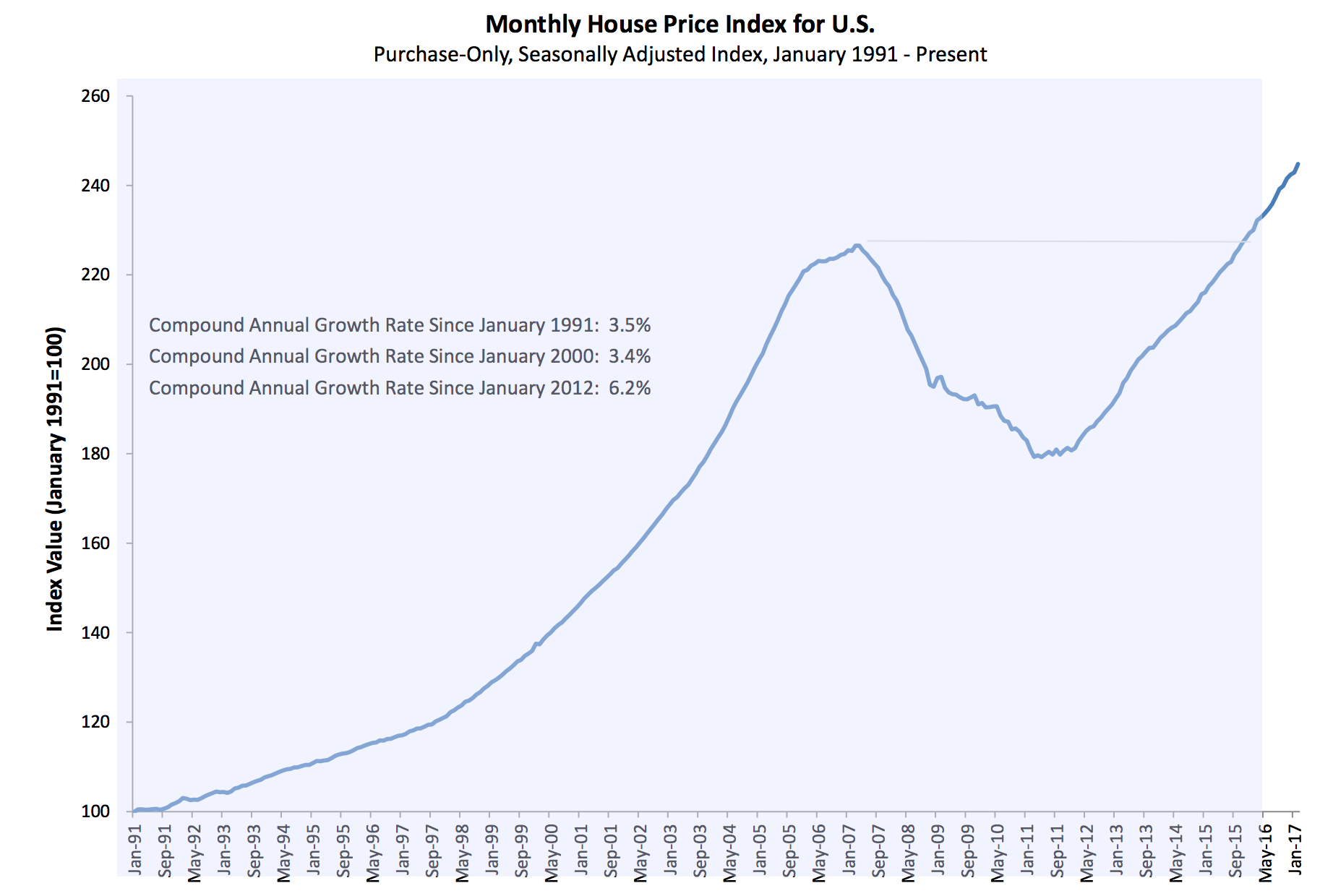

Home prices increased in February both month-over-month and annually, according to the Federal Housing Finance Agency’s seasonally adjusted monthly House Price Index.

Home prices rise 0.8% in February, the index shows, and the previous halt in January’s home price growth was revised upward to a 0.2% increase. Home prices increased 6.4% annually.

But FHFA isn’t the only index showing an increase in home prices in February. Tuesday, the Case-Shiller indices reported home prices increase to an all-time high for the fourth consecutive month.

And Black Knight’s report Monday also showed home prices hit a new high in February.

This chart shows that since around 2012, home prices have steadily grown each year.

Click to Enlarge

(Source: FHFA)

The FHFA monthly HPI is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. Because of this, the selection excludes high-end homes bought with jumbo loans or cash sales.

Across the nine census divisions, seasonally adjusted monthly price changes in February ranged from a decrease of 0.1% in the South Atlantic division to an increase of 1.8% in the East South Central division. Annually, all changes were positive, ranging from an increase of 4.6% in the Middle Atlantic division to 9.5% in the Mountain division.

Here is a list of which states are in each of those divisions:

South Atlantic: Delaware, Maryland, District of Columbia, Virginia, West Virginia, North Carolina, South Carolina, Georgia, Florida

East South Central: Kentucky, Tennessee, Mississippi, Alabama

Middle Atlantic: New York, New Jersey, Pennsylvania

Mountain: Montana, Idaho, Wyoming, Nevada, Utah, Colorado, Arizona, New Mexico