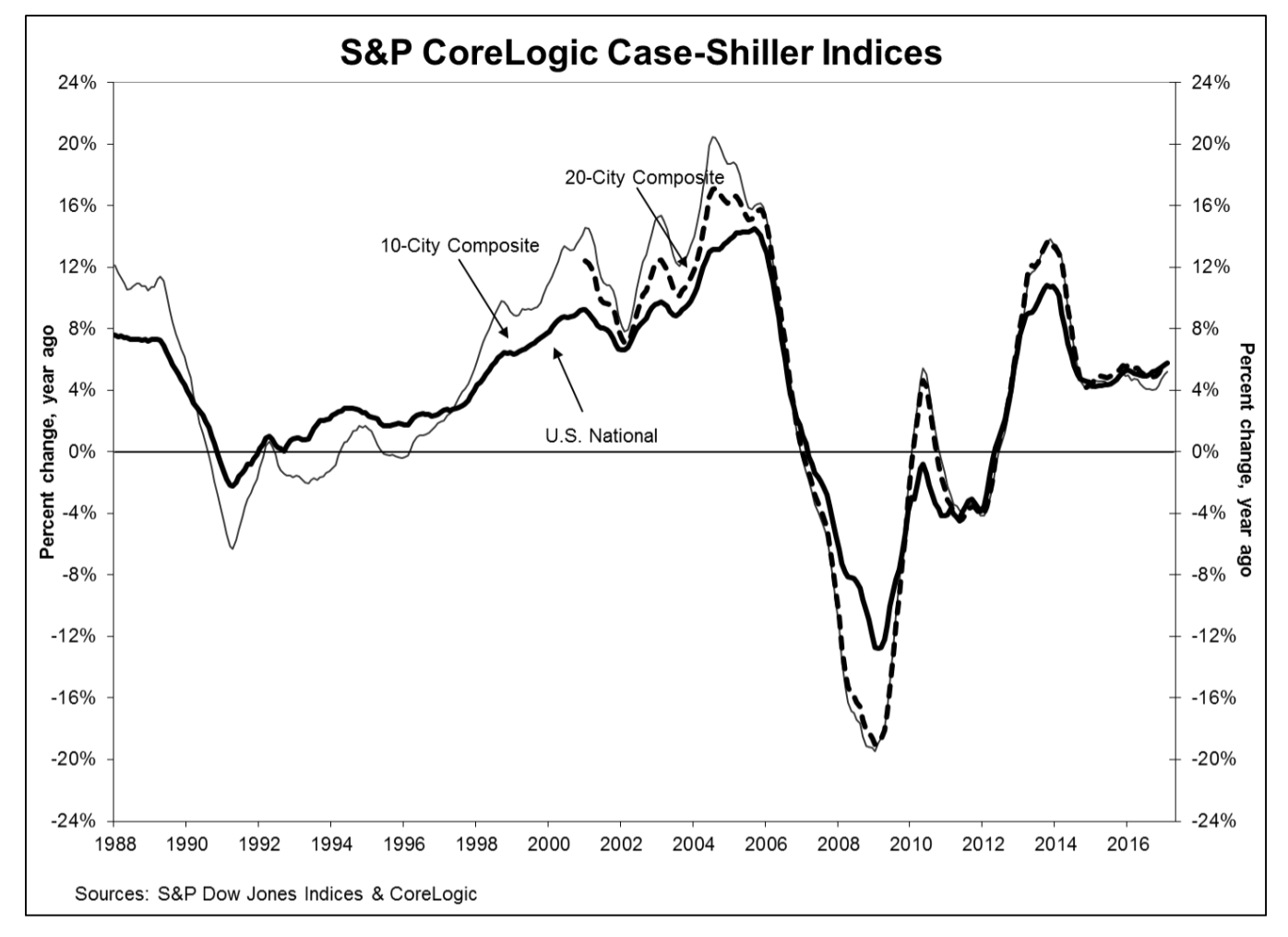

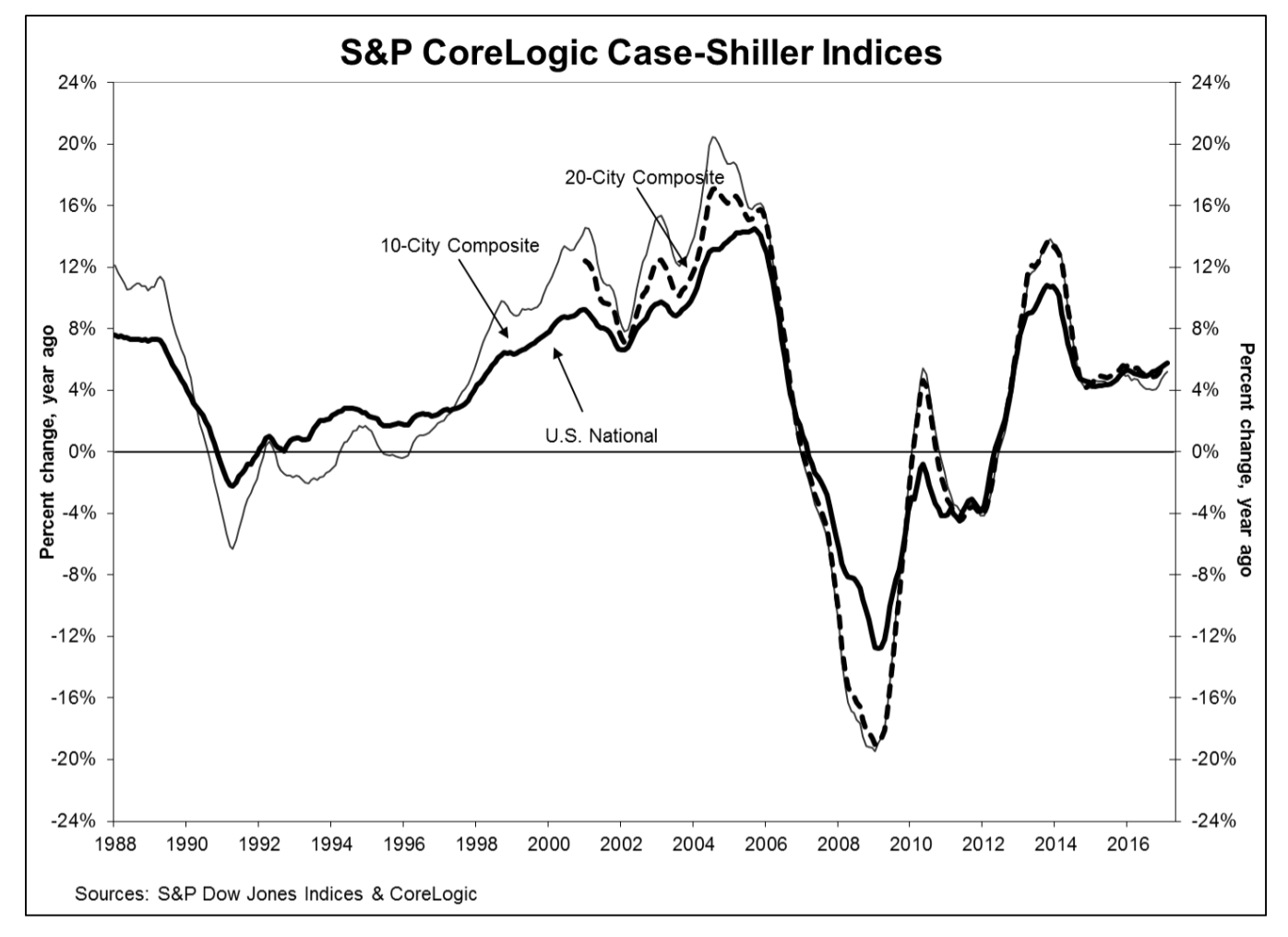

Home prices continued to expand in February, hitting their fourth consecutive all-time high, according to the S&P Dow Jones Indices.

The S&P CoreLogic Case-Shiller Indices, a national measure of U.S. home prices, increased both month-over-month and year-over-year in February. The National Home Price NSA Index, which covers all nine U.S. census divisions, increased by 5.8% in February, up from last month’s 5.6% increase.

Similarly, the 10-City Composite increased 5.2% annually, up from 5% in January, and the 20-City Composite increased 5.9% from last year, up from 5.7% last month.

Click to Enlarge

(Source: S&P CoreLogic Case-Shiller Indices)

“Housing and home prices continue to advance,” said David Blitzer, S&P Dow Jones Indices managing director and chairman of the Index Committee. “The S&P Corelogic Case-Shiller National Home Price Index and the two composite indices accelerated since the national index set a new high four months ago.”

Within the top 20 cities, Seattle, Portland and Dallas took the lead with annual home price increases of 12.2%, 9.7% and 8.8% respectively. Dallas was the only new city in the top three, and replaced Denver in the third spot.

“Other housing indicators are also advancing, but not accelerating the way prices are,” Blitzer said. “As per National Association of Realtors sales of existing homes were up 5.6% in the year ended in March.”

“There are still relatively few existing homes listed for sale and the small 3.8-month supply is supporting the recent price increases,” he said. “Housing affordability has declined since 2012 as the pressure of higher prices has been a larger factor than stable to lower mortgage rates.”

In addition to the annual increases, home prices also increased month over month. Before seasonal adjustment, the National Index increased 0.2% in February. The 10-City Composite increased 0.3% and the 20-City Composite increased 0.4%.

However, after seasonal adjustment, the National index reported a 0.4% monthly increase. The 10-City Composite increased 0.6% and the 20-City Composite increased 0.7%.

“Housing’s strength and home building are important contributors to the economic recovery,” Blitzer said. “Housing starts bottomed in March 2009 and, with a few bumps, have advanced over the last eight years. New home construction is now close to a normal pace of about 1.2 million units annually, of which around 800,000 are single family homes.”

“Most housing rebounds following a recession only last for a year or so,” he said. “The notable exception was the boom that set the stage for the bubble. Housing starts bottomed in 1991, drove through the 2000-2001 recession, and peaked in 2005 after a 14-year run.”