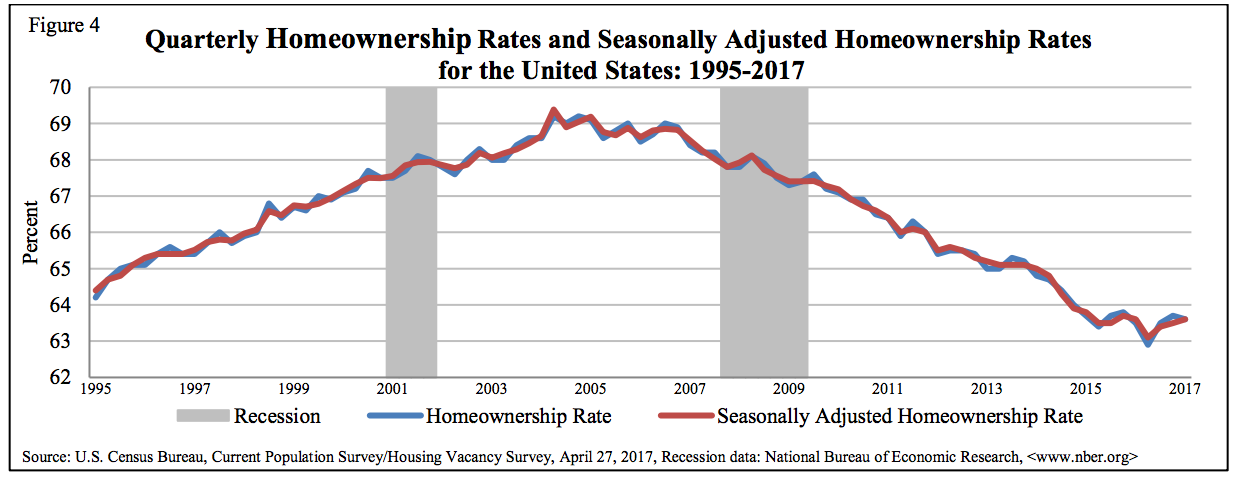

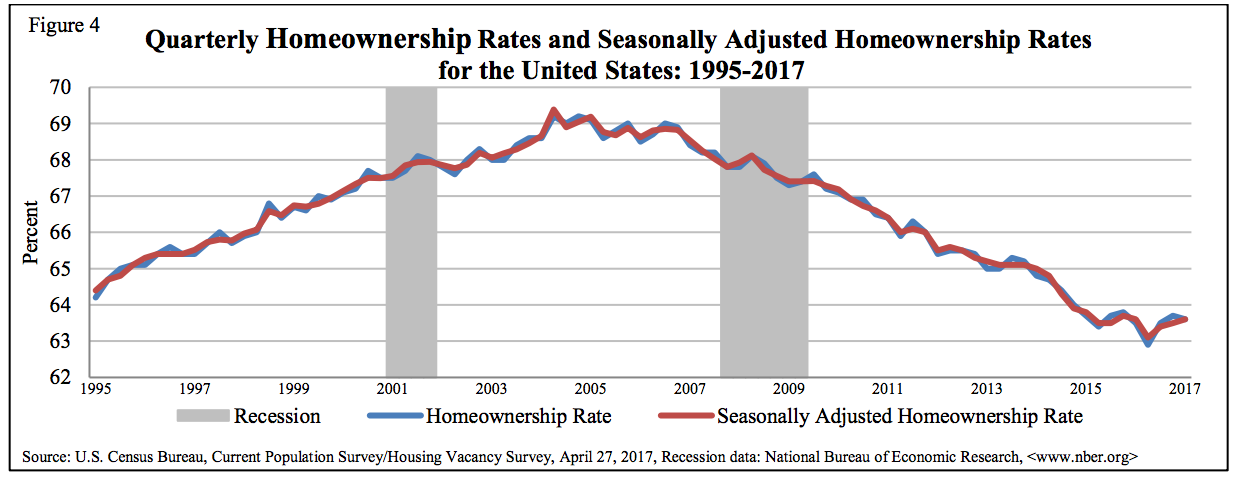

The homeownership rate continues to hover near all-time lows, showing little signs of improvement from last quarter or even last year.

The homeownership rate for the first quarter of 2017 barely moved, inching up to 63.6%, up slightly from 63.5% last quarter and down from 63.7% last year, according to the first quarter report from the U.S. Census Bureau.

Click to Enlarge

(Source: U.S. Census Bureau)

The homeownership rate dropped to its lowest rate since 1965 in the second quarter last year when it hit 62.9%.

National vacancy rates also remained steady at 7% in the first quarter for rental vacancies, unchanged from the fourth quarter and up slightly from 6.9% last year. The homeowner vacancy rate remained unchanged from last year at 1.7%. This was down slightly from 1.8% in the fourth quarter.

The Midwest holds the highest homeownership rate at 67.6%, followed by the South at 65.4%, the Northeast at 60.6% and the West at 59%.

Unsurprisingly, homeownership rates were highest for those ages 65 and older at 78.6%, and lowest for those 35 and younger and 34.3%, the report showed.

“Today’s homeownership report is fairly underwhelming, with most key indicators largely remaining flat or changing only modestly,” Zillow Chief Economist Svenja Gudell said.

“But there are a few bright spots under the hood,” Gudell said. “Hispanic and black homeownership rates both rose, even as they still remain far below white and Asian rates.”

By race, White households held the highest homeownership rate at 71.8%, followed by Asian, Native Hawaiian and Pacific Islander at 56.8%. Hispanic households came in at 46.6%.

The only race to see a significant change from last quarter’s numbers were Black households, which held the lowest rate at 42.7%, up slightly from the fourth quarter’s 41.7%.