Several reports showed home prices continue to increase as affordability falls, however affordability will plummet even more next year.

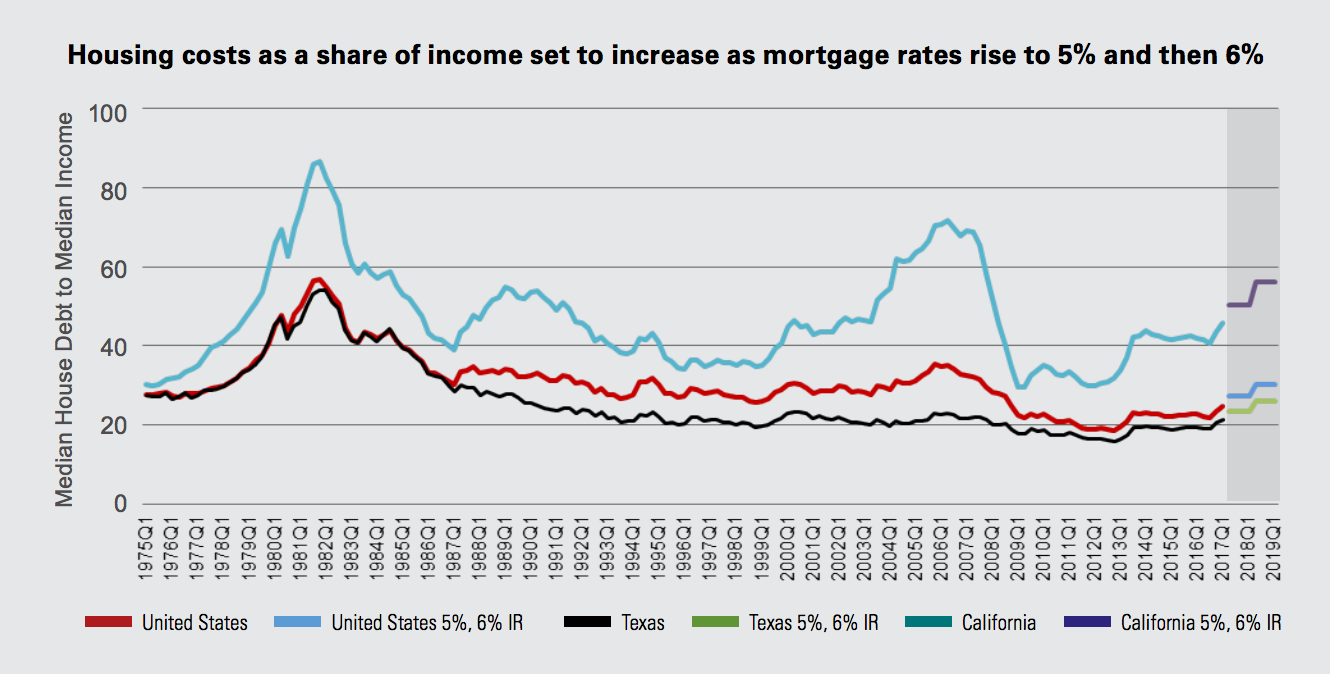

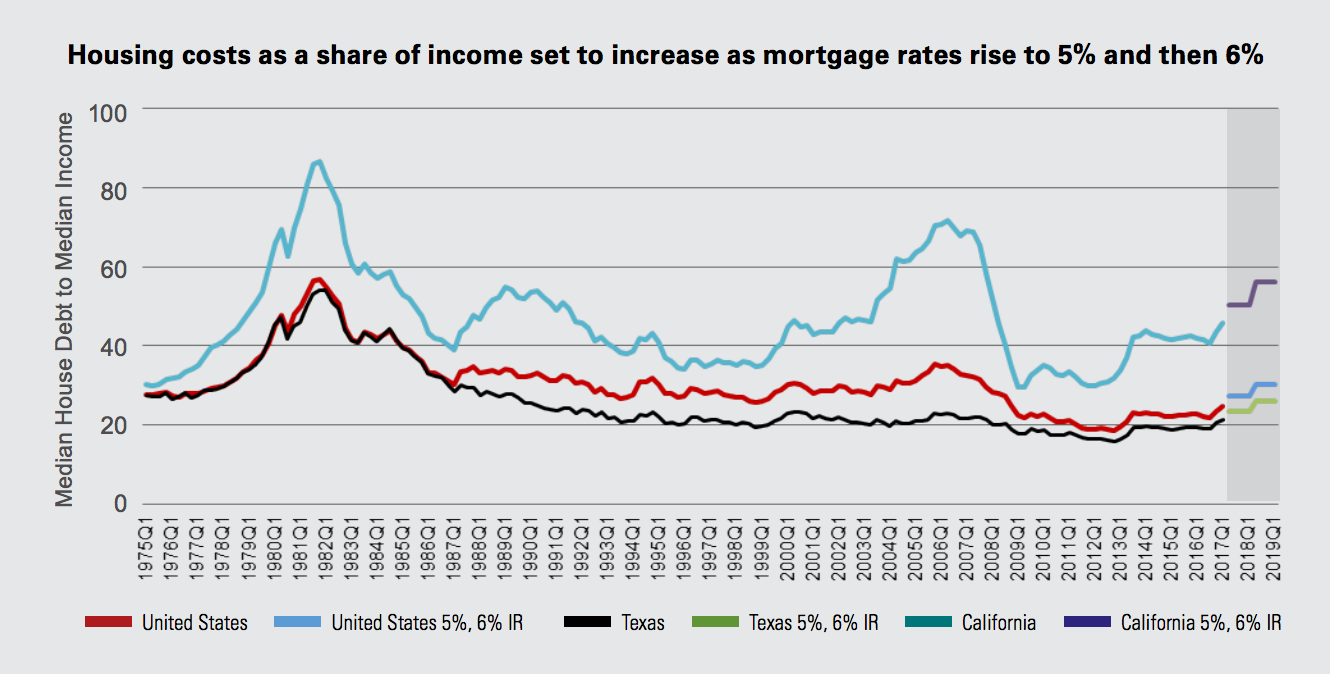

The Federal Reserve plans to raise interest rates once more this year, and several times over the next couple of years. Currently, the 30-year fixed-rate mortgage hovers near 4%. A new report from Arch MI gives the scenario if interest rates increase to 5% or 6%.

The report shows the U.S. median existing home price is $246,000. The corresponding $1,200 monthly mortgage payment would require 25% of the median household’s $58,000 a year in pre-tax income.

However, if rates rise to 5%, the median debt-to-income increases 2% to 27% for the U.S. overall. In Texas, median DTI would increase from 21% to 23%, however California’s would increase from 46% to 50%.

If rates increase to 6%, the median DTI would increase to 31% for the U.S., 26% for Texas and 56% for California.

The chart below shows the decrease in affordability for the two scenarios.

Click to Enlarge

(Source: Arch MI)

However, the report explains these increases, while drastic, are increasing from the current historical lows. From the report:

While large projected increases seem dramatic after a long period of mortgage rates hovering near historic lows, thankfully median DTIs are currently lower than their historical averages in most areas. For the United States overall, median DTI would just move up to the historical average since 1975. For median DTI to be similar to the “normal” years (1990 to 2004), rates need to be around 5.5%.

While home prices peaked in 2007, total housing costs peaked much before that in the 1980s when interest rates spiked to nearly 18%, the report explains. Housing costs hit a low in 2012 to 2013 as home prices and interest rates fell after the crash.

Since then, affordability worsened as home prices increased faster than incomes. But while interest rates will increase to an estimated 5% by the end of 2018 and 6% by the end of 2019, most economists expect home price growth will also slow to between 2% and 4% once rates begin to rise.

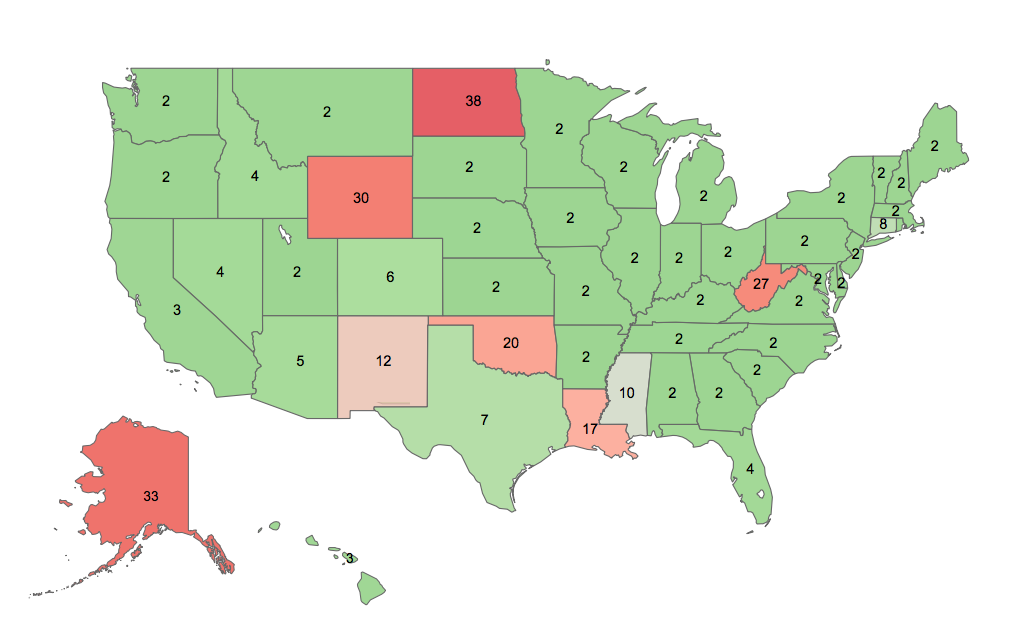

But while home price increases may slow, there is little chance of seeing them fall through 2018. The average probability that home prices will decrease in America’s largest 400 cities remains unusually low at 4%.

The map below shows the states that are most at risk of home prices dropping.

Click to Enlarge

(Source: Arch MI)