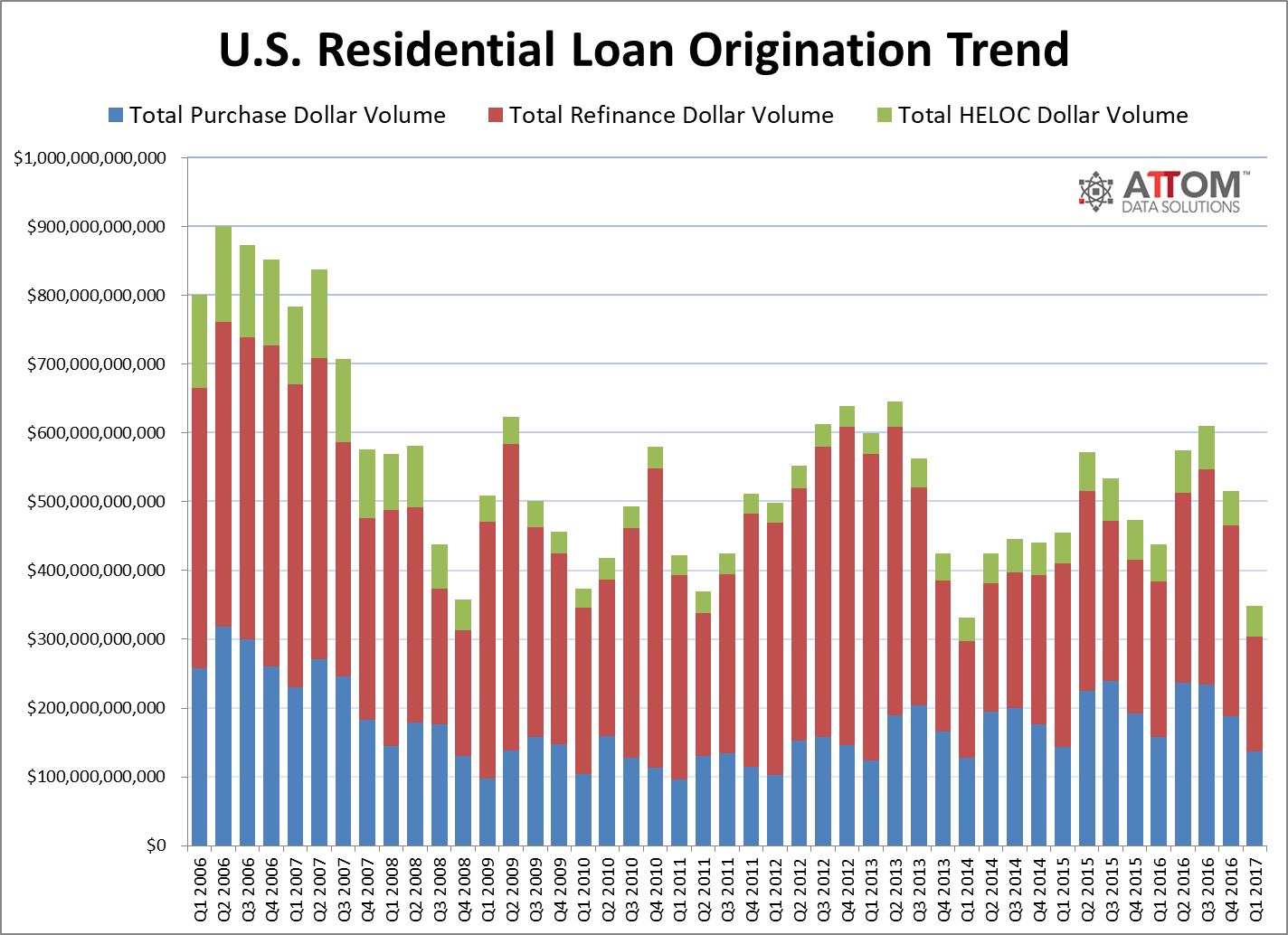

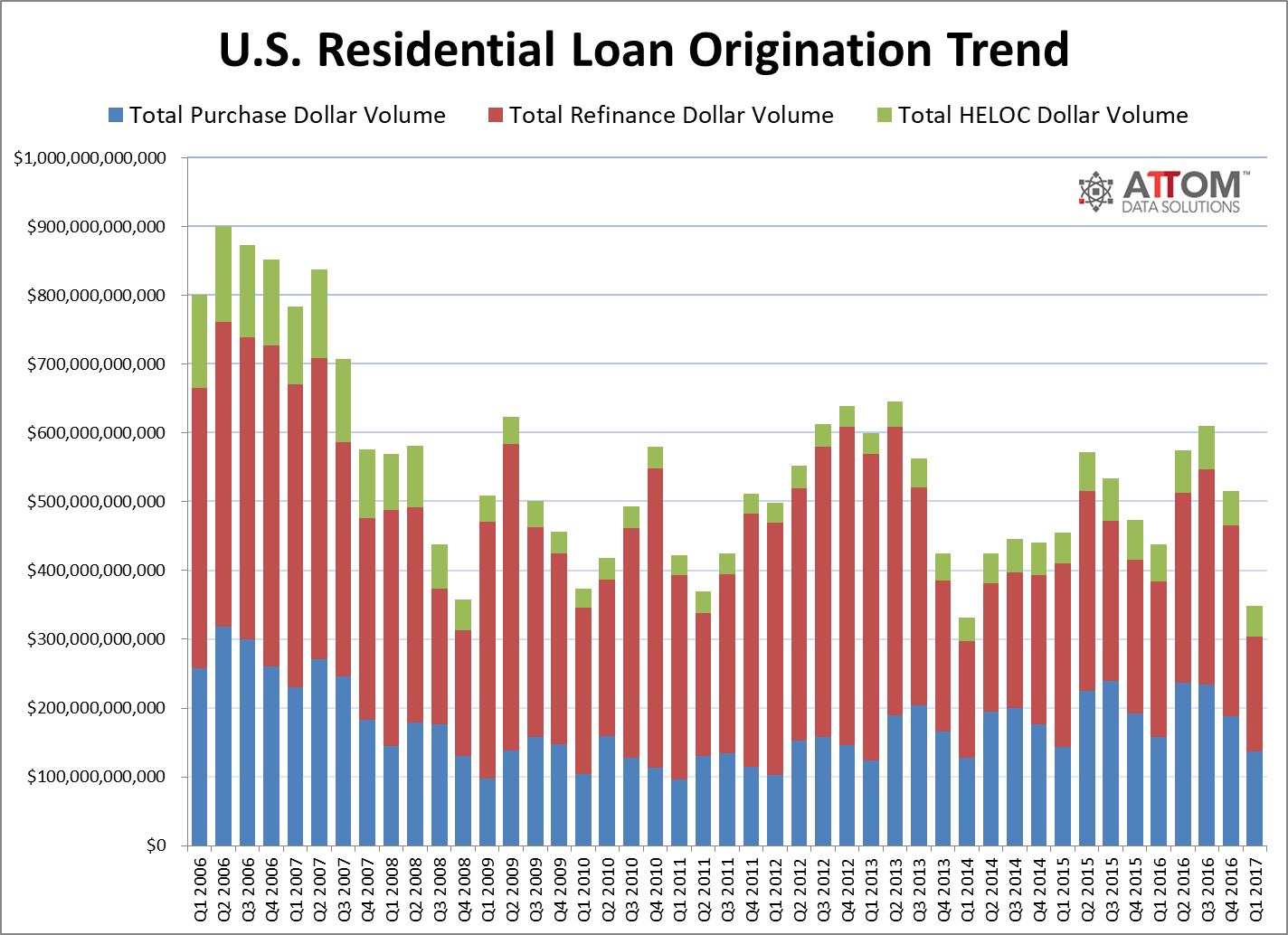

Mortgage rates may sit at a yearly low right now, but earlier in the year rates sat well north of 4%, and that drove first-quarter refinance originations to the lowest level in 10 years, a new report from Attom Data Solutions shows.

According to Attom’s Q1 2017 U.S. Residential Property Loan Origination Report, released Thursday, there were a total of 675,899 refinance loans secured by U.S. residential properties (1 to 4 units) originated in the first quarter, which is down 36% from the previous quarter and down 22% from a year ago.

The report also showed that the total dollar volume of refinance originations in the first quarter was $167.9 billion, which is down 39% from the fourth quarter of 2016 and down 26% from a year ago.

That’s the lowest that figure has been since the first quarter of 2006, which is as far back as data is available in Attom’s report.

Overall, there were 1,415,847 loans originated on residential properties in the first quarter of 2017, down 30% from the previous quarter and down 21% from a year ago.

The total dollar amount on the loans was down as well. According to the Attom report, the total dollar volume of loan originations in the first quarter fell by 21% from a year ago to $347.9 billion.

That’s the lowest that figure has been since the first quarter of 2014.

Purchase origination dollar volume also fell to a three-year low. According to Attom’s report, there were a total of 513,350 purchase loans originated in the first quarter, down 29% from the previous quarter and down 18% from a year ago.

The report also showed that the total dollar volume of purchase originations in the first quarter was $136.6 billion, down 27% from the previous quarter and down 14% from a year ago to the lowest level since the first quarter of 2014.

(Click the image to enlarge it. Image courtesy of Attom Data Solutions.)

“Rising mortgage rates made qualifying for a home purchase more difficult and refinancing an existing home loan less attractive in the first quarter,” Daren Blomquist, senior vice president at Attom Data Solutions, said.

“Refinance originations in particular fell off a cliff in the first quarter to the lowest level in more than 10 years after posting double-digit percentage increases in the third and fourth quarters of 2016, indicating that some refinance demand was pulled forward late last year in anticipation of rising interest rates,” Blomquist said.

The report also showed that Home Equity Lines of Credit fell to a three-year low as well. Attom’s report showed that there were a total of 226,598 HELOCs originated in Q1 2017, down 14% from the previous quarter and down 22% from a year ago.

The total dollar volume of HELOCs originated during the first quarter was $43.4 billion, down 14% from the previous quarter and down 18% from a year ago to a three-year low.

“Despite the sharp drop in purchase originations, there were some encouraging signs in the data that a larger share of first-time homebuyers participated in the housing market in the first quarter: the share of FHA buyers increased from the previous quarter after two consecutive quarters down, and the median down payment decreased following three consecutive quarters of increases,” Blomquist added.

“The data also indicates more homebuyers needed help to qualify for a home purchase in the first quarter,” Blomquist concluded. “Nearly 22% of all single family purchase originations had multiple, non-married co-borrowers on the loan, up from 20% a year ago.”