Cash sales ticked up slightly for the second month in a row in August, according to a new report from CoreLogic.

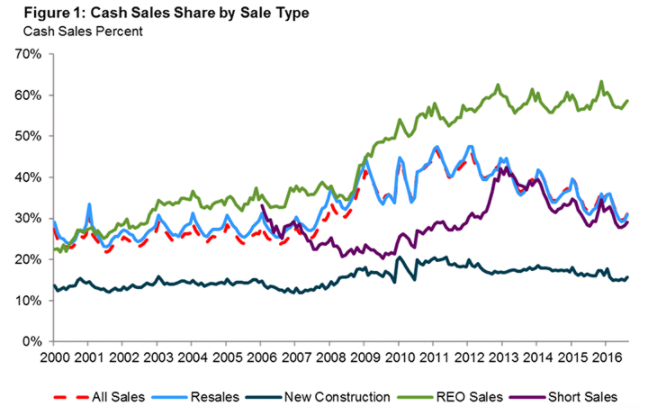

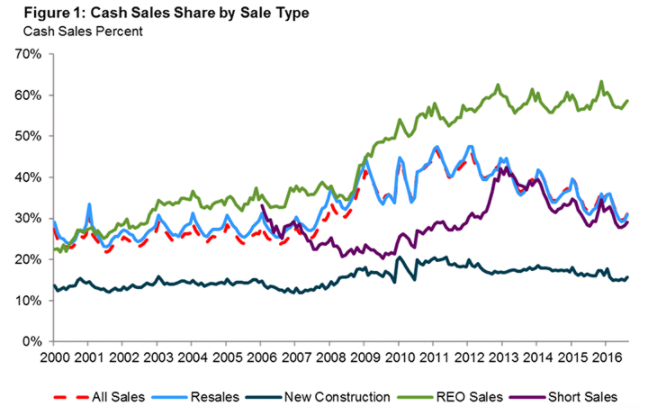

Cash sales increased to 31.1% of total home sales in August, up from July’s 29.7%. However, this is still down 1.5 percentage points from last year. Before the housing crisis, cash sales averaged 25% of total market sales.

If the cash sales share continues to fall at the same annual rate it did in August 2016, the share should hit 25% by mid-2019. This is a big delay from last month’s prediction, which put cash sales at their pre-crisis level by mid-2018.

Real estate owned sales had the largest share of cash sales in August at 58.6%, followed by resales at 31%, short sales at 29.1% and newly constructed homes at 15.6%.

While REO sales have the highest percentage of cash sales, they make up only 4.6% of the market. Short sales make up 2.7% of the market, putting distressed sales at 7.3% of the market, the lowest share for any month since September 2007.

At their peak in 2009, distressed sales made up 32.4% of the market, and REOs were 27.9% of that. On the other hand, pre-crisis distressed sales levels averaged 2%. If the current year-over-year decrease in the distressed sales share continues, it will reach that “normal” 2% mark in mid-2018.

Click to Enlarge

(Source: CoreLogic)

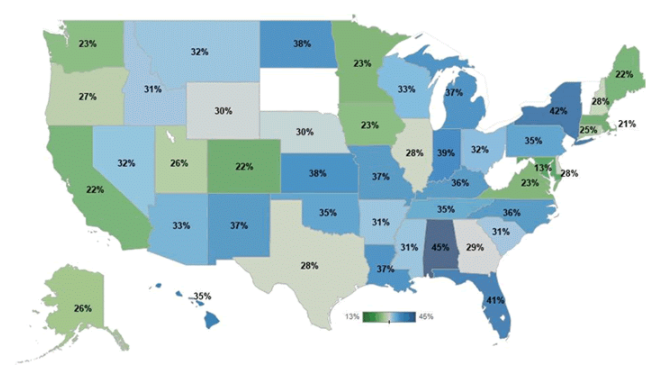

The state with the largest share of distressed sales was Maryland with 19.1%, followed by Connecticut at 18.5%, Michigan at 17.7%, New Jersey at 15.9% and Illinois at 15.3%.

North Dakota had the smallest share of the market’s distressed sales at 2.6%.

Click to Enlarge

(Source: CoreLogic)