Mortgage delinquencies dropped in April and the economy continued to show improvement, according to the latest Loan Performance Insights Report from CoreLogic, a property information, analytics and data-enabled solutions provider.

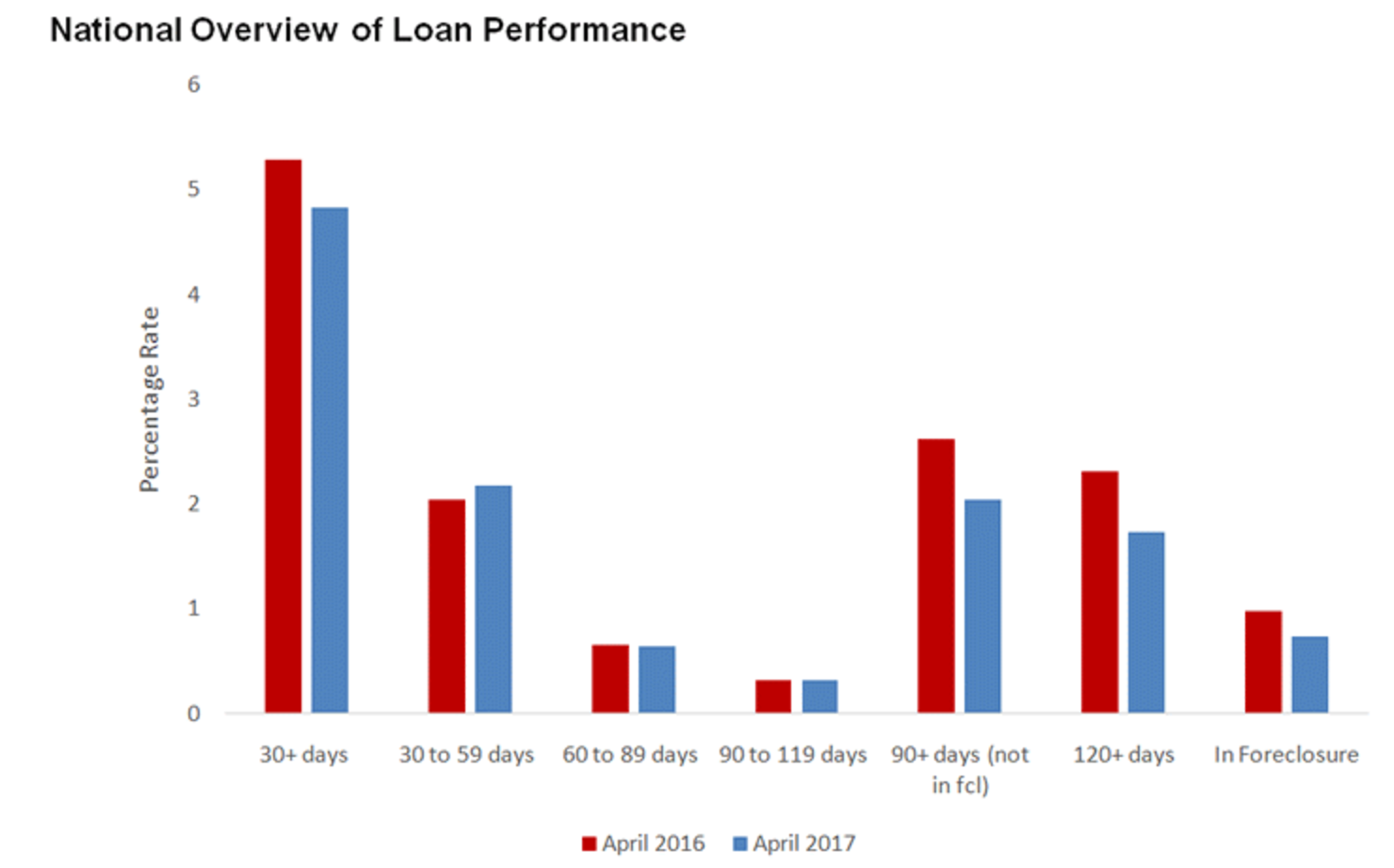

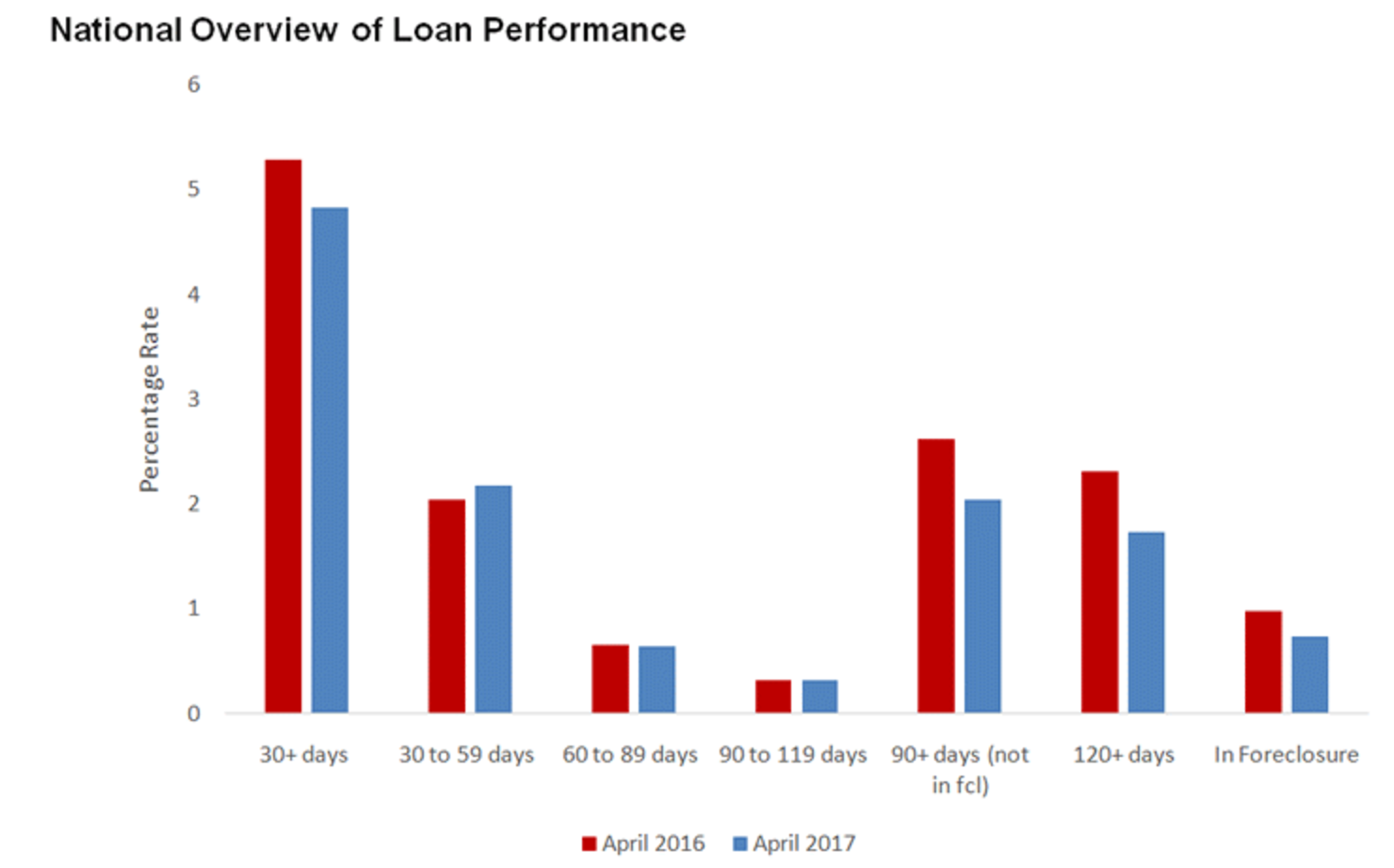

Nationally, mortgages in some stage of delinquencies, those that are 30 days or more past due including those in foreclosure, dropped to 4.8% of total mortgages in April. This is a decrease of 0.5 percentage points from last year’s 5.3%.

The foreclosure inventory rate, which measures the share of mortgages in some stage of the foreclosure process, decreased to 0.7%, down from April 2016’s 1%. The serious delinquency rate, defined as 90 days or more past due including loans in foreclosure, also decreased, dropping from last year’s 2.6% to 2% this April.

“Most major indicators of mortgage performance improved in April, showing that the market continues to benefit from improved economic growth and home price increases,” CoreLogic Chief Economist Frank Nothaft said. “Regionally, with the exception of several energy industry intensive states, Alaska and North Dakota, the rest of the U.S. continues to see improvements in mortgage performance.”

“While overall performance is improving, it reflects the older legacy pipeline of loans that continue to heal, especially in judicial states which typically take longer to clear out,” Nothaft said.

Early-stage delinquencies, mortgages 30 to 59 days past due, increased slightly to 2.2%, up from 2% in April last year. The chart below shows loan performance across all loan types.

Click to Enlarge

(Source: CoreLogic)

“Delinquency rates are down virtually across the board as the rebound in the U.S. housing market continues to gather steam,” CoreLogic President and CEO Frank Martell said. “It appears likely that delinquency rates will continue to fall for some time, but at a moderating pace.”

“As we look forward, improved fundamentals provide us with a firm foundation and we must now increase our attention to carefully expand the supply of affordable housing stock and ensure that mortgage lending policies help to prudently promote first-time homeownership,” Martell said.