Home prices increase a little more each month, even hitting new peaks in many markets, yet experts insist they are not back at bubble-era levels.

The most recent Case-Shiller results show home prices rose 5.8% from last year to the highest pace in 33 months.

Black Knight also released its Home Price Index Report, showing home prices rose to a median $272,000 in March. This represents a new peak in home prices, and a rise of 2.3% from the start of the year.

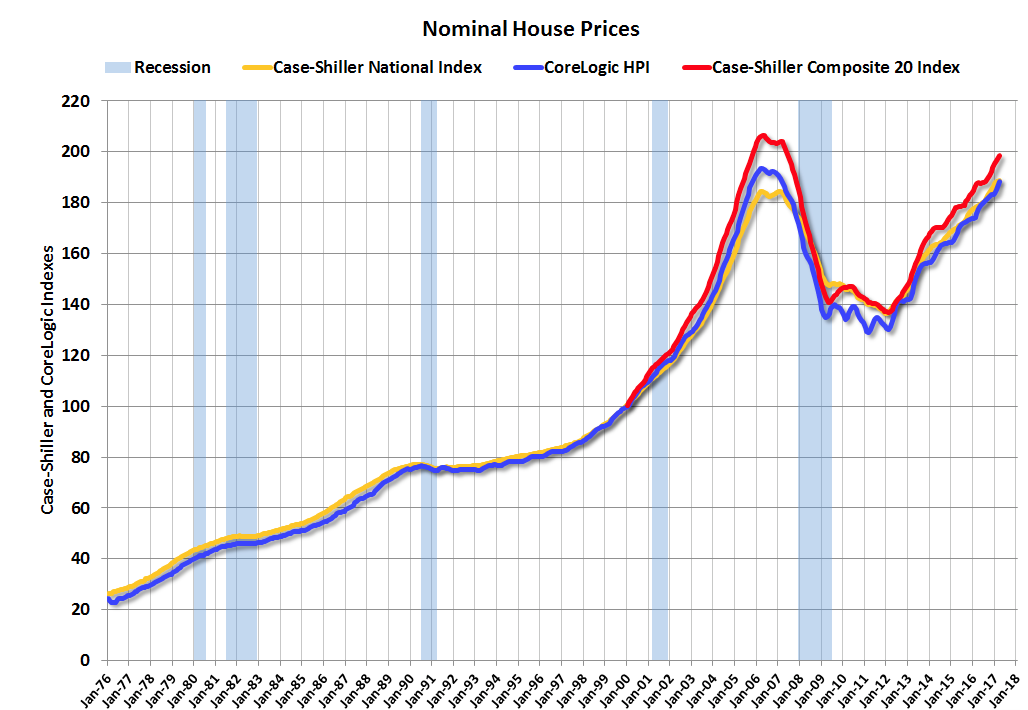

In fact, the chart below from Calculated Risks blog shows home prices are nearing, if not level with, pre-crisis peaks, according to different measures of home prices such as the Case-Shiller index and CoreLogic’s HPI.

Click to Enlarge

(Source: Calculated Risk)

However, a report from First American Financial Corp. shows that while affordability is decreasing, home prices adjusted for changes in income and interest rates are still well below the pre-crisis level.

First American’s measure of affordability, what it calls real house prices, increased 0.7% in March and 11.5% from last year. However, they are still 32.5% below the housing boom peak in July 2006 and even 9.3% below prices in January 2000.

“Real, purchasing-power adjusted house prices are rising even faster than unadjusted home prices alone, primarily due to declining consumer purchasing power,” First American Chief Economist Mark Fleming said. “Strong Millennial demand, a limited supply of homes for sale, and higher mortgage rates have all combined to impact the affordability of homes compared to a year ago.”

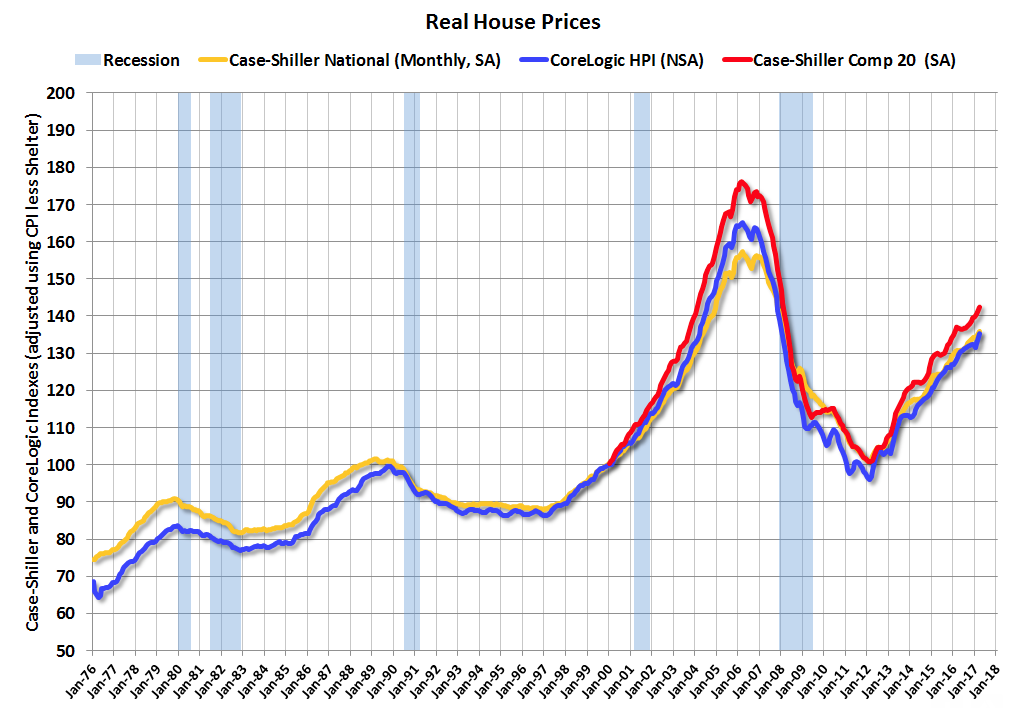

And using the same measures of home prices as the chart above, but adjusting for inflation, shows home prices, while higher than historic averages, are still well below bubble-era levels.

Click to Enlarge

(Source: Calculated Risk)

“Housing has definitely increased in price on an inflation-adjusted basis since the mid-70s, however improvements in financing, interest rates, different products etc., have increased people’s buying power and that may account for some of the increase,” Brent Nyitray, iServe Residential Lending director of capital markets, wrote in his daily note to clients.