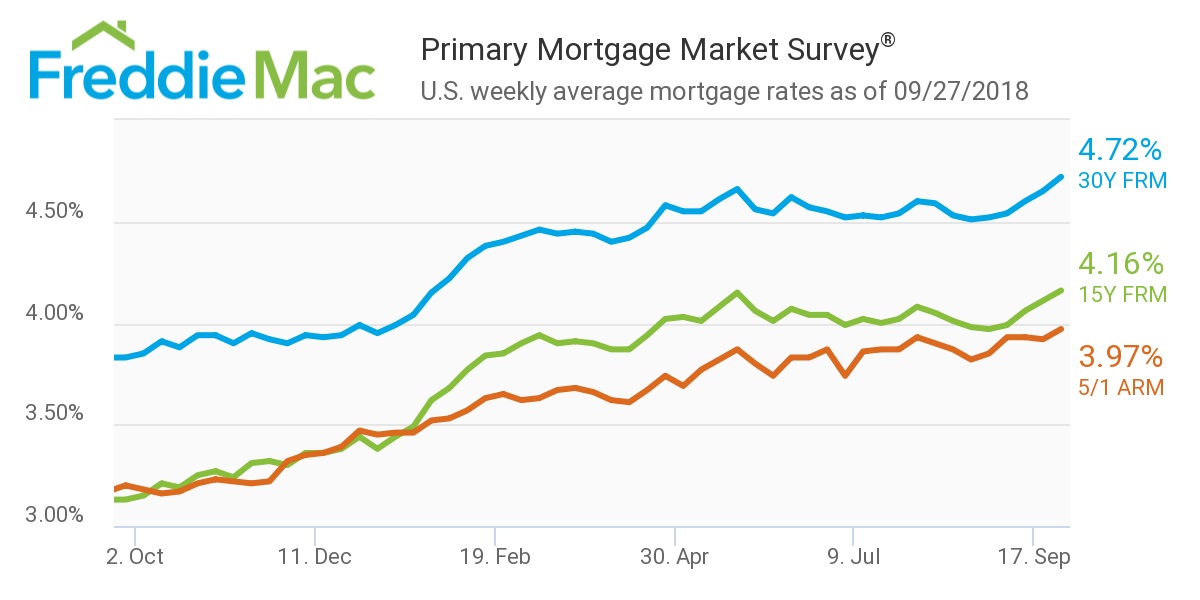

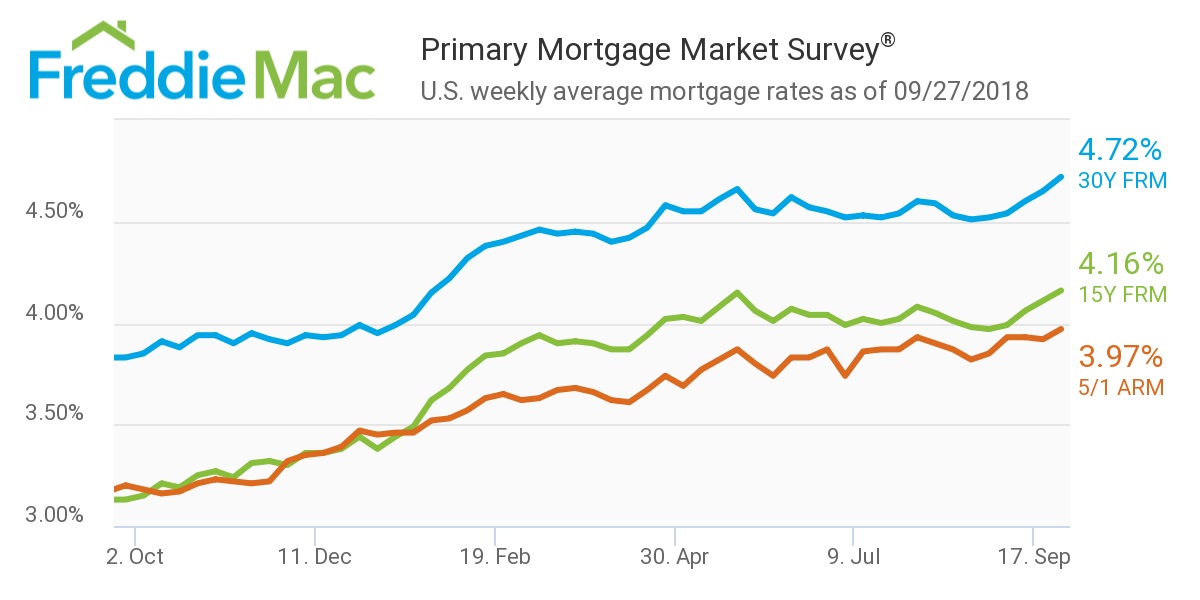

Mortgage spiked to their highest level in over seven years, according to Freddie Mac’s latest Primary Mortgage Market survey.

Freddie Mac Chief Economist Sam Khater said the 30-year fixed-rate mortgage climbed for the fifth consecutive week to 4.72%, which is a high not seen since April 28, 2011.

According to the Primary Mortgage Market survey, the 30-year fixed-rate mortgage averaged 4.72% for the week ending Sept. 27, 2018, shooting up from 4.65% last week, remaining relatively higher than last year’s rate of 3.83%.

“The robust economy, rising Treasury yields and the anticipation of more short-term rate hikes caused mortgage rates to move up,” Khater continued. “Even with these higher borrowing costs, it’s encouraging to see that prospective buyers appear to be having a little more success. With inventory constraints and home prices starting to ease, purchase applications have now trended higher on an annual basis for six straight weeks.”

(Source: Freddie Mac)

The 15-year FRM averaged 4.16% this week, increasing from last week’s 4.11%. This time last year, the 15-year FRM averaged was 3.13%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage moved forward to 3.97% this week, increasing from 3.92% the week before. This is still up from this time last year when it was 3.20%.

“Consumer confidence is at an 18-year high, and job gains are holding steady,” Khater stated. “These two factors should keep demand up in coming months, but at the same time, home shoppers will likely deal with even higher mortgage rates.”