In many ways, Zillow was one of the leaders in the online real estate revolution, helping to democratize the home buying process and enabling prospective buyers to search for their next home from the comfort of their current home.

And now, Zillow wants to revolutionize the way that people sell their homes as well, as the online real estate giant announced this week that it is launching a pilot program called “Zillow Instant Offers.”

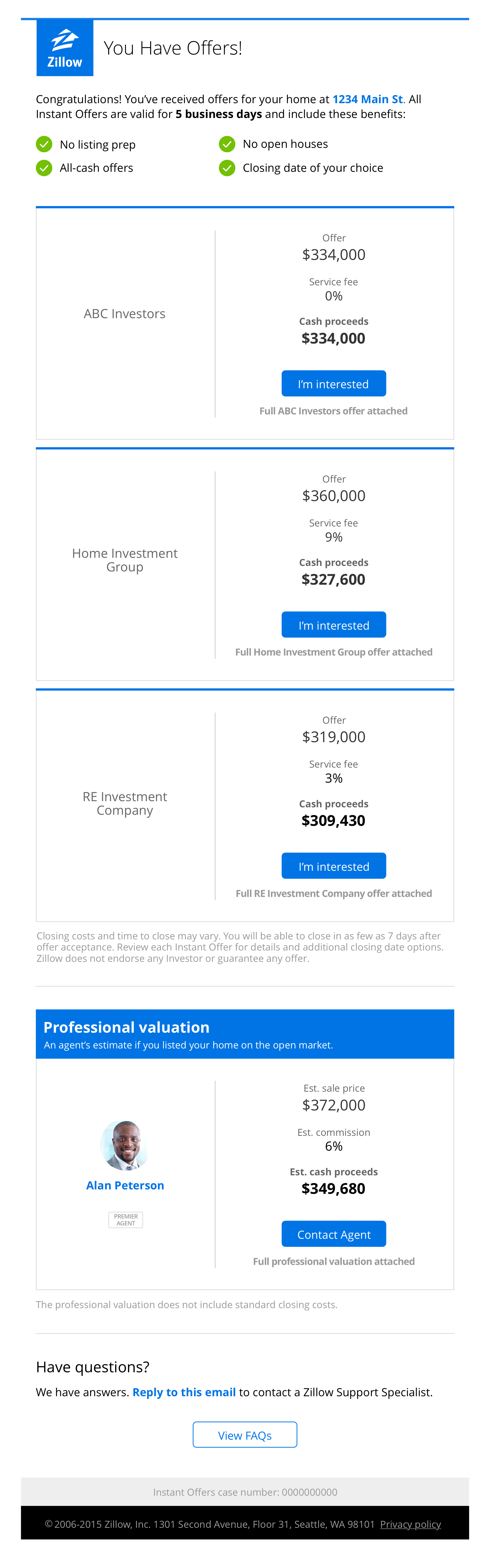

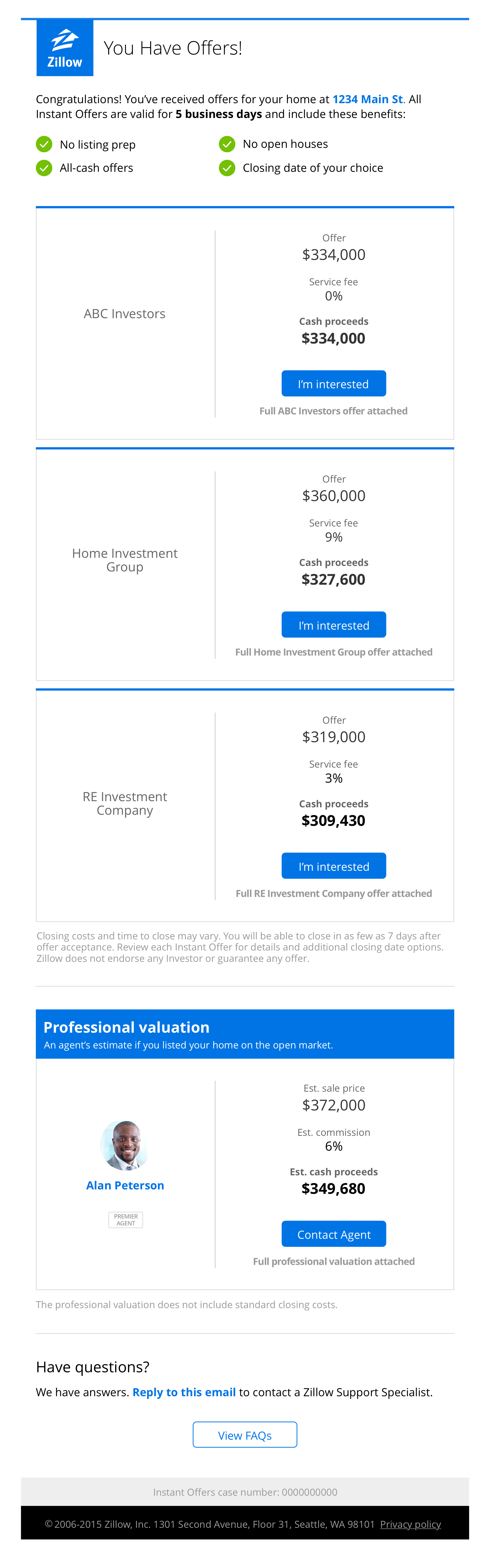

Through the program, which is now testing in Las Vegas and Orlando, homeowners looking to sell their home will be able to get cash offers on their home from selected investors interested in buying it, all within Zillow’s platform.

If the seller decides to use the “Instant Offer” program, they will also receive a comparative market analysis from a local real estate agent, which would allow them to compare the investor offers to what their home might be worth on the open market.

Consider it a “Zestimate” on steroids.

Zillow’s Zestimate, the property value estimation tool that appears on every listing on Zillow, serves as a point of contention for real estate professionals and consumers alike.

As previously noted, homebuyers and sellers often believe the Zestimate to be the true market value of the home, rather than simply a “great starting point” for determining the value of a home, as Zillow describes it.

When Zillow claimed last year that it significantly improved the accuracy of its Zestimate tool, the company said that ultimately a home is worth only what someone is willing to pay for it.

And now, home sellers that use the “Instant Offers” program will have concrete, tangible offers from investors ready and willing to buy their home, as well as an analysis of what their home might be worth if they list it on the open market instead.

Here’s how it works, according to Zillow:

To participate in Zillow Instant Offers, verified homeowners interested in receiving investor offers confirm information about the home (number of bedrooms, square footage, etc.), highlight any updates and provide several photos of the home. From there, select investors who buy homes in the area can present their offers alongside the CMA from a local real estate agent. Any investor offers and the CMA will include an overview of fees associated with each option, to enable sellers to make an informed apples-to-apples comparison.

The seller is not obligated to accept any of the investor offers, but in a release, Zillow said that it believes the program will help sellers who may not be interested in the traditional home selling process.

“People today expect speed and convenience as the foundation for many of their transactions – including when buying or selling a home,” Zillow said in a release.

“Selling a home can often be an overwhelming task as home sellers have the challenge of getting their home ready to list on the open market, while facing the uncertainty of when their home might sell and at what price,” Zillow continued.

“By using the Zillow Instant Offers marketplace, home sellers can alleviate some of that stress by eliminating the need to prepare their home for sale (staging, open houses, etc.), and gain additional control and certainty over aspects like closing date and price,” Zillow added.

If any of this sounds familiar, it’s because this is basically the business model of Opendoor, an online marketplace that buys homes direct from homeowners.

Here’s how Opendoor, which currently operates in Phoenix and Dallas-Fort Worth, works: A homeowner seeking to sell their home can go to Opendoor, enter details about their home, and get a near-instant price quote for the home.

Then, if the seller accepts, Opendoor then allows the seller to close on the sale when they’re ready, rather than on the timeline of another buyer.

While Opendoor cuts real estate agents out of the process, Zillow states that “Instant Offers” will include agents throughout the process.

In addition to investors being required to use an agent, should a homeowner select an investor’s offer, Zillow will also offer to connect them with a local agent to represent them throughout the transaction, Zillow said in its release.

Zillow doesn’t provide much detail on the investors who will participating the pilot program, simply stating the following in its release: “During this test in Las Vegas, Nev., and Orlando, Fla., Zillow is working with a handful of agents and select investors in each test market, who are active in the area. Participating agents will be requested to record the sale with their local Multiple Listing Service.”

An article about the program from Inman stated that Invitation Homes is participating in the pilot. HousingWire can confirm Invitation Homes’ involvement in the program, via a Zillow spokesperson. HousingWire contacted Invitation Homes for comment on its participation in the program, but as of publication, the single-family rental operator has not responded.

So why is Zillow doing this? Jeremy Wacksman, Zillow Group’s chief marketing officer, said that the company is trying to fulfill the needs of its users.

“Sellers are looking for more solutions when selling their home. For some, selling in a short timeframe with certainty around the closing date is attractive, or even necessary,” Wacksman said.

“Across many industries, we’re seeing a rise of technology assisted transactions, and many consumers desire this type of innovation in real estate,” Wacksman said.

“We want to provide options for convenience, while providing home sellers with useful information to help them make an informed financial decision,” Wacksman concluded. “That’s why we provide them with any offers submitted by investors, as well as an estimate from a real estate agent who can help them better understand what that home may sell for on the open market.”

Investors who participate in the program will also be doing so using DotLoop, a company that aims to simplify real estate transactions by enabling brokerages, real estate agents, and their clients to share, edit, sign and store documents digitally.

DotLoop is also a subsidiary of Zillow Group, which bought the company for north of $100 million back in 2015.

The article from Inman states that Zillow will not be taking a cut of these transactions, perhaps alleviating concerns about RESPA, the Real Estate Settlement Procedures Act.

Zillow is already facing a RESPA investigation from the Consumer Financial Protection Bureau related to its real estate agent advertising program.

But if the Instant Offer program proves successful, will Zillow begin to officially act as a broker and take a percentage of each sale? Inquiring minds (at the CFPB and beyond) will want to know.

No matter what, the real estate world is facing another seismic shift thanks to Zillow.

Here’s a look at what a seller will see on Zillow’s platform when they recieve the offers:

(Click the image to enlarge it. Image courtesy of Zillow.)