Homeowner equity increased significantly in the first quarter of 2017, according to the Q1 2017 home equity analysis from CoreLogic, a property information, analytics and data-enabled solutions provider.

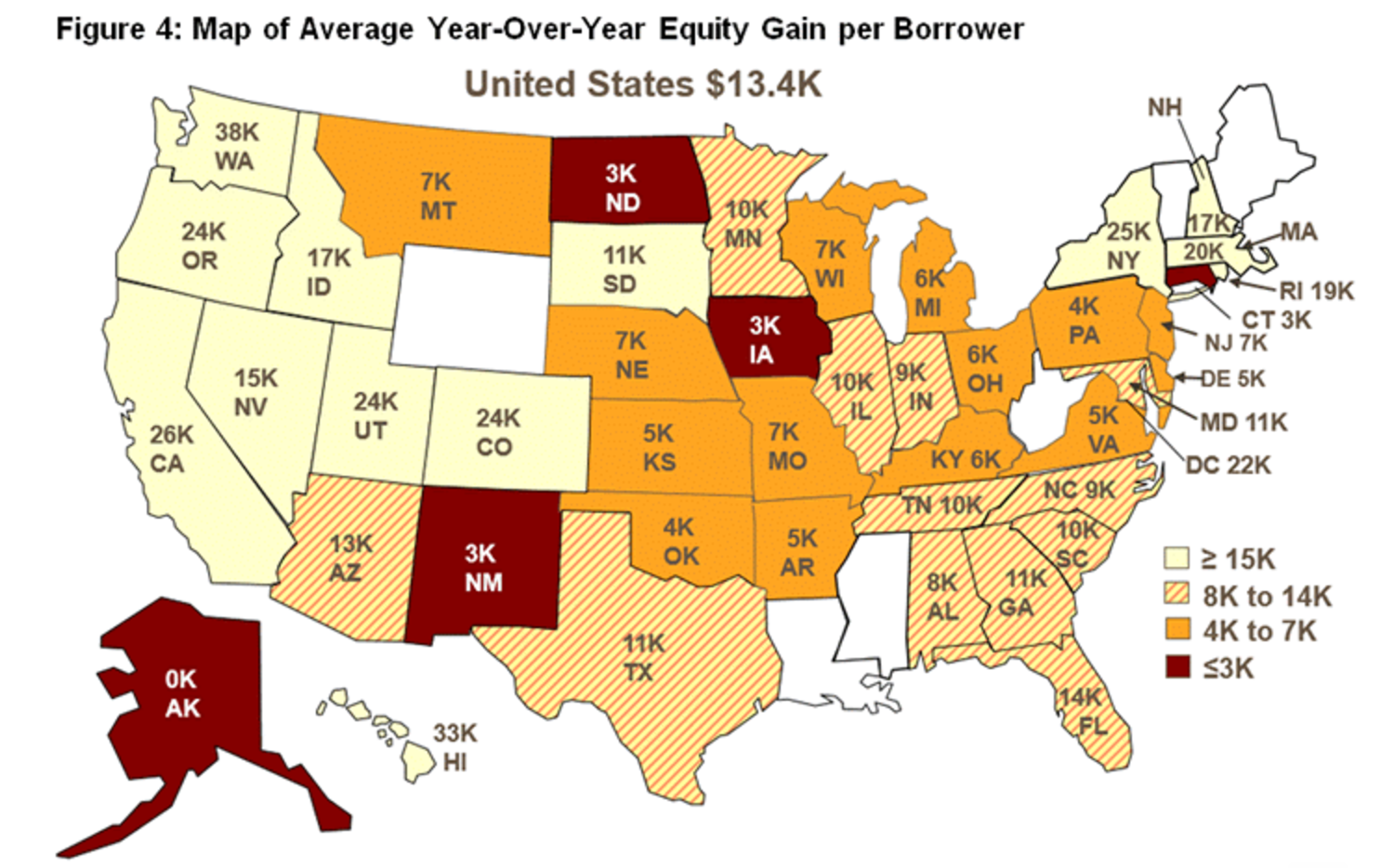

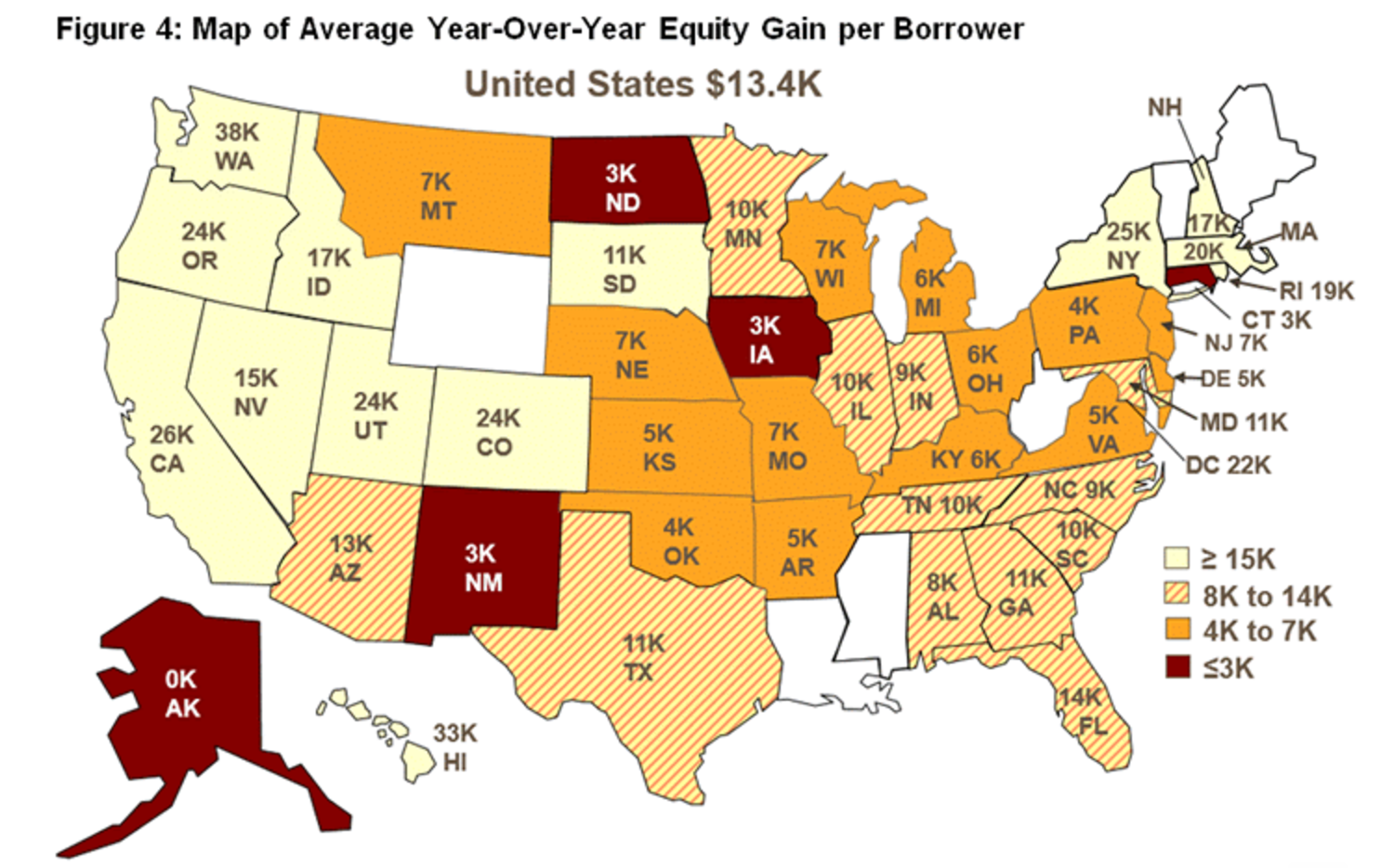

Homeowners with a mortgage, about 63% of all homeowners, saw their equity increase by 11.2% a total of $766.4 billion since the first quarter last year. The average homeowner gained about $13,400 in equity over the last year.

The total number of mortgaged residential properties with negative equity decreased 3% from the fourth quarter to 3.1 million homes, or 6.1% of all mortgaged properties. This is a drop of 24% from 4.1 million homes in the first quarter last year.

“One million borrowers achieved positive equity over the last year, which means mortgage risk continues to steadily decline as a result of increasing home prices,” CoreLogic Chief Economist Frank Nothaft said. “Pockets of concern remain with markets such as Miami, Las Vegas and Chicago, which are the top three for negative equity among large metros, with each recording a negative equity share at least twice or more the national average.”

This chart shows which states saw the largest equity gains from last year.

Click to Enlarge

(Source: CoreLogic)

Negative equity, often referred to as being underwater or upside down, applies to borrowers who owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in home value, an increase in mortgage debt or both.

The value of negative equity in the U.S. at the end of the first quarter totaled about $283 billion. This is down 0.9% by about $2.6 billion from $285.5 billion in the fourth quarter and 7.1% from last year’s $304.5 billion.

“Homeowner equity increased by over $750 billion during the last year, the largest increase since mid-2014,” CoreLogic President and CEO Frank Martell said. “The rising cushion of home equity is one of the main drivers of improved mortgage performance. It also supports consumer balance sheets, spending and the broader economy.”