Those looking to buy a home may not be happy with the increasing home prices, however there is an upside for one group – homeowners.

The third quarter saw an increased by 3.1% or $227 billion from last quarter in homeowner equity, according to the latest report from CoreLogic, a global property information, analytics and data-enabled solutions provider.

That increase brought 384,000 borrowers out of negative equity in the third quarter, and increased the number of homes with positive equity to 93.7% of all mortgaged properties. Home equity grew by $726 billion or 10.8% from the third quarter of 2015.

“Price appreciation is the main ingredient for home equity wealth creation, and home prices rose 5.8% in the year ending September 2016, according to the CoreLogic Home Price Index,” CoreLogic President and CEO Anand Nallathambi said.

“Paydown of principal is the second key component of equity building,” Nallathambi said. “Many homeowners have refinanced into shorter-term loans, such as a 15-year loan, and by doing so, they have significantly fewer mortgage payments and are able to build equity wealth faster.”

About 3.2 million residential properties held negative equity in the third quarter, or 6.3% of all homes with a mortgage. This is a decrease of 10.7% from last quarter’s 3.6 million homes or 7.1% of homes with a mortgage and a decrease of 24.1% from last year’s 4.2 million homes or 8.4% of all mortgaged properties.

Negative equity, often referred to as “underwater” or “upside down,” applies to borrowers who owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in home value, an increase in mortgage debt or a combination of both.

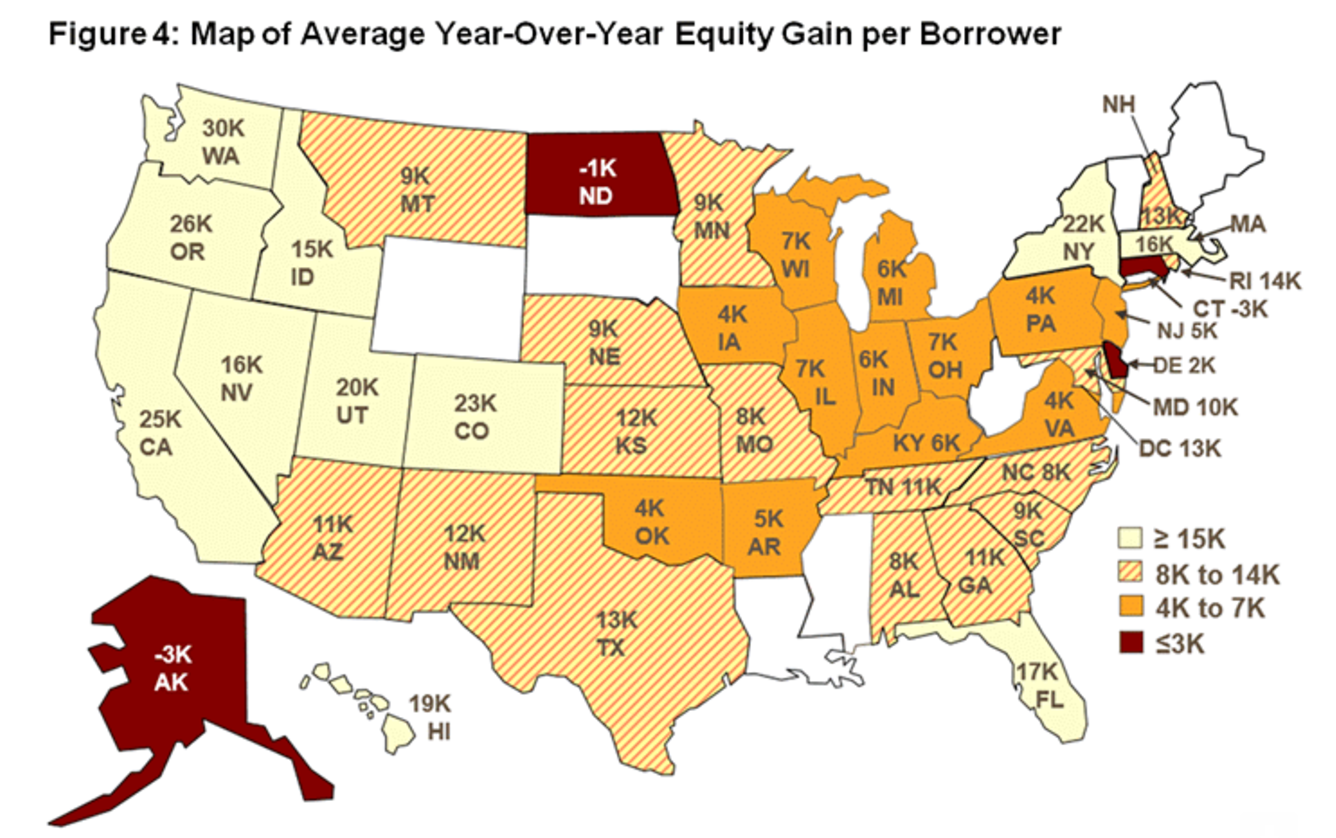

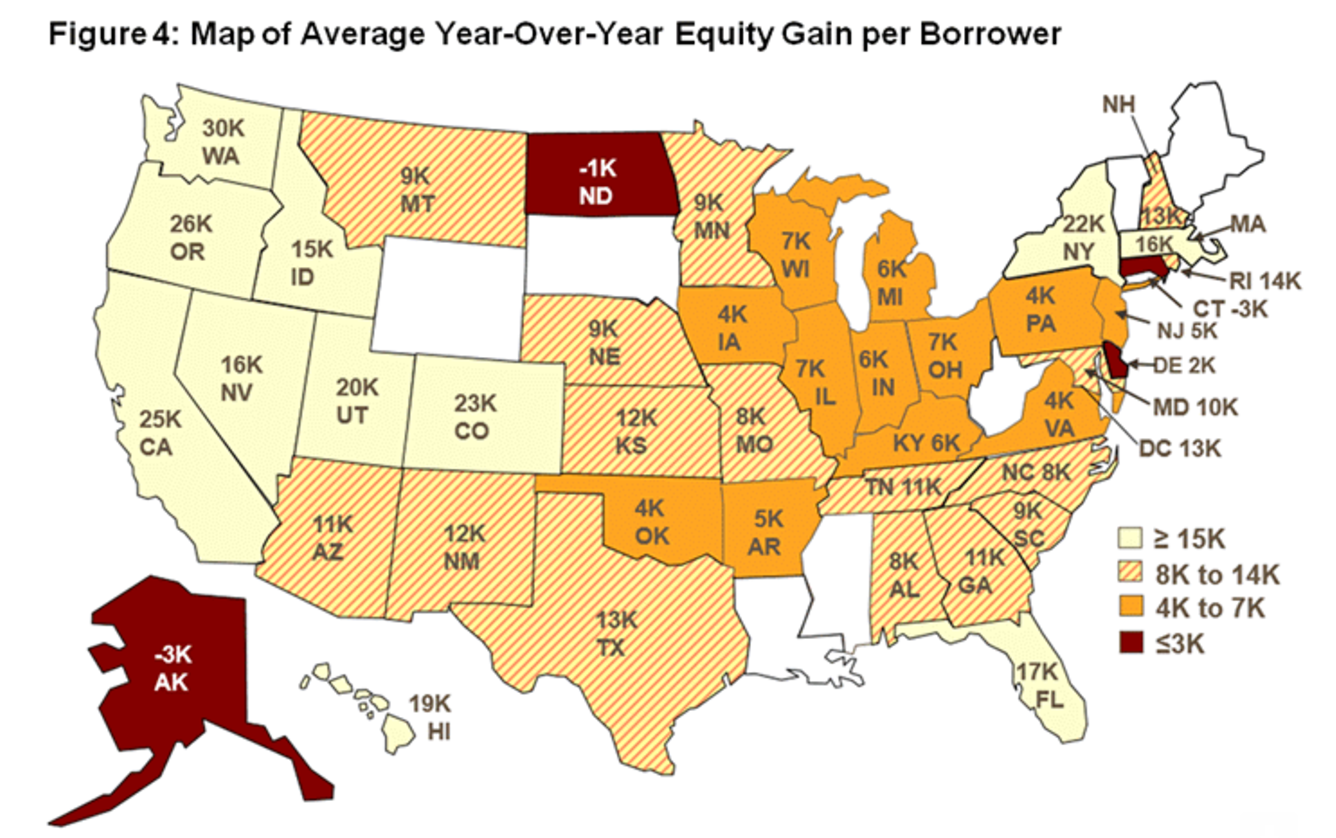

“Home equity rose by $12,500 for the average homeowner over the last four quarters,” CoreLogic Chief Economist Frank Nothaft said. “There was wide geographic variation with homeowners in California, Oregon and Washington gaining an average of at least $25,000 in home equity wealth, while owners in Alaska, North Dakota and Connecticut had small declines, on average.”

Click to Enlarge

(Source: CoreLogic)

The state with the highest percentage of homes not underwater in the third quarter was Texas with 98.4% of homes with positive equity. This was followed by Alaska with 98.1%, Colorado with 97.9%, Utah with 97.9% and Washington with 97.9%.