Before buying a home, most borrowers look to save up for a down payment and build up their credit, however, in some areas, buying may actually require a lower FICO than when trying to rent.

Nationwide, the average credit score needed to rent an apartment was 650, while those with a score of 538 and below were typically rejected, according to a recent study by RENTCafé based on tenant screening data from RentGrow, a resident screening service.

Of course, that differed depending on the class of apartment a tenant was looking to move in to. The chart below shows the breakdown for high-, mid- and low-end apartments.

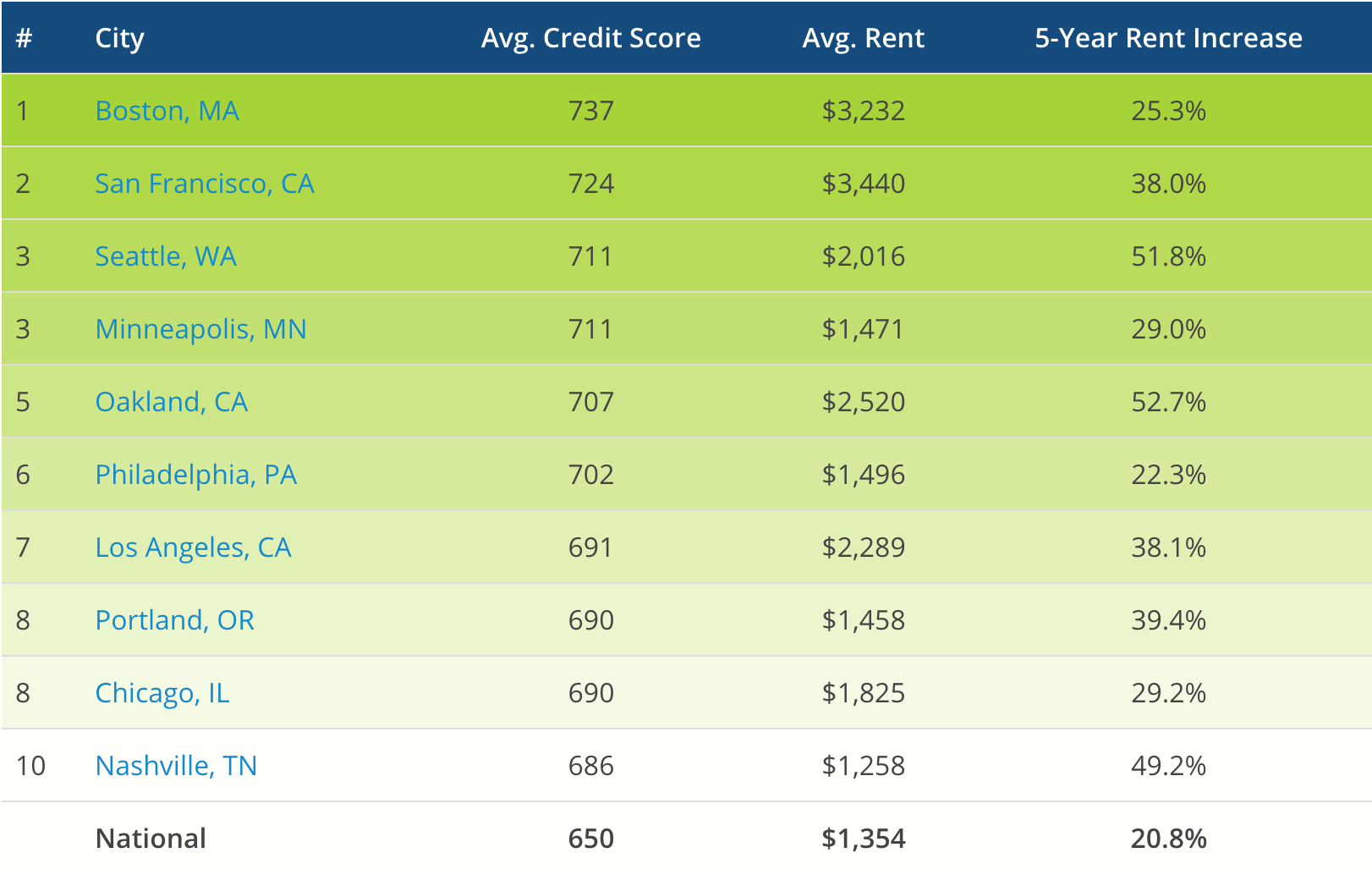

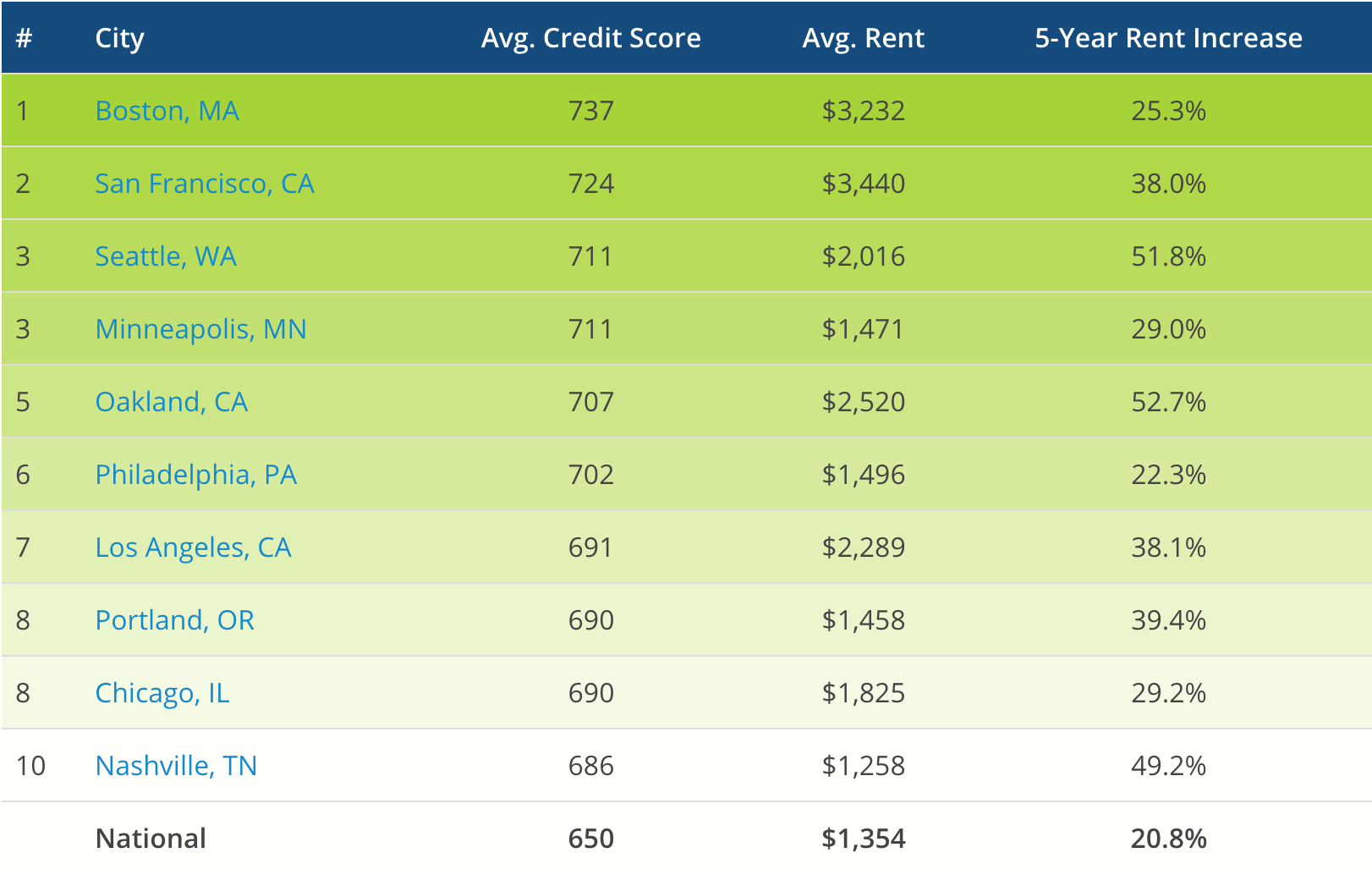

But the level of credit score needed varies much more significantly based on the city. Many hot rental markets across the U.S. require credit scores over 700 such as Boston, San Francisco and Seattle, where required credit scores are 737, 724 and 711 consecutively.

What’s more, the rent prices for each of these cities is also incredibly high at $3,440 in San Francisco, $3,232 in Boston and $2,016 in Seattle. The chart below shows the top 10 cities with the highest average approved credit scores for renting in 2017.

Click to Enlarge

(Source: RENTCafé)

In Boston, for example, the average rejected credit score came in at 667 for apartments in 2017. However, for a mortgage loan from the Federal Housing Administration a borrower must have a FICO score of 580 to qualify for the 3.5% down-payment program.

As of October 2017, Zillow’s Home Value Index shows the median home value in Boston is $561,000. In order to pay the same amount for rent as one would pay for a home in Boston, borrowers who put 3.5% down could afford a home priced at $500,000, slightly lower than the area’s median home price if they secured an interest rate of 5%.

Not only could buying a home cost less each month for homeowners, but with the area’s rising FICO score requirements, it is also easier to get accepted.

Once again the numbers show – buying a home trumps renting.