The National Flood Insurance Program is set to expire six months from Thursday on Sept. 30, 2017, prompting the National Association of Realtors to try to bring awareness to the expiration and its consequences: a disruption in closing loans.

NAR noted that while the NFIP isn’t perfect and reforms are needed, it will continue working closely with everyone involved to achieve those reforms.

“Good work has been done in Congress, at FEMA and elsewhere to clear the way for those efforts. We thank leaders on both sides of the aisle for all they’ve done up to this point. Now, it’s time for action. Congress has six months to do the right thing and pass a long-term reauthorization of the program. We’re hoping they do just that,” said NAR President William Brown, founder of Investment Properties.

If nothing is done, NAR stressed that the expiration would “deal significant damage to current policy-holding property owners, as well as threaten property sales and the broader housing market.”

Putting the impact into perspective, NAR pointed out that when the NFIP expired in 2010, more than 1,300 home sales were disrupted every day as a result.

“That’s over 40,000 every month. Flood insurance is required for a mortgage in the 100-year floodplain, but without access to the NFIP, buyers simply couldn’t get a mortgage or vital protection from the No. 1 cause of loss of property and life: flooding,” said Brown.

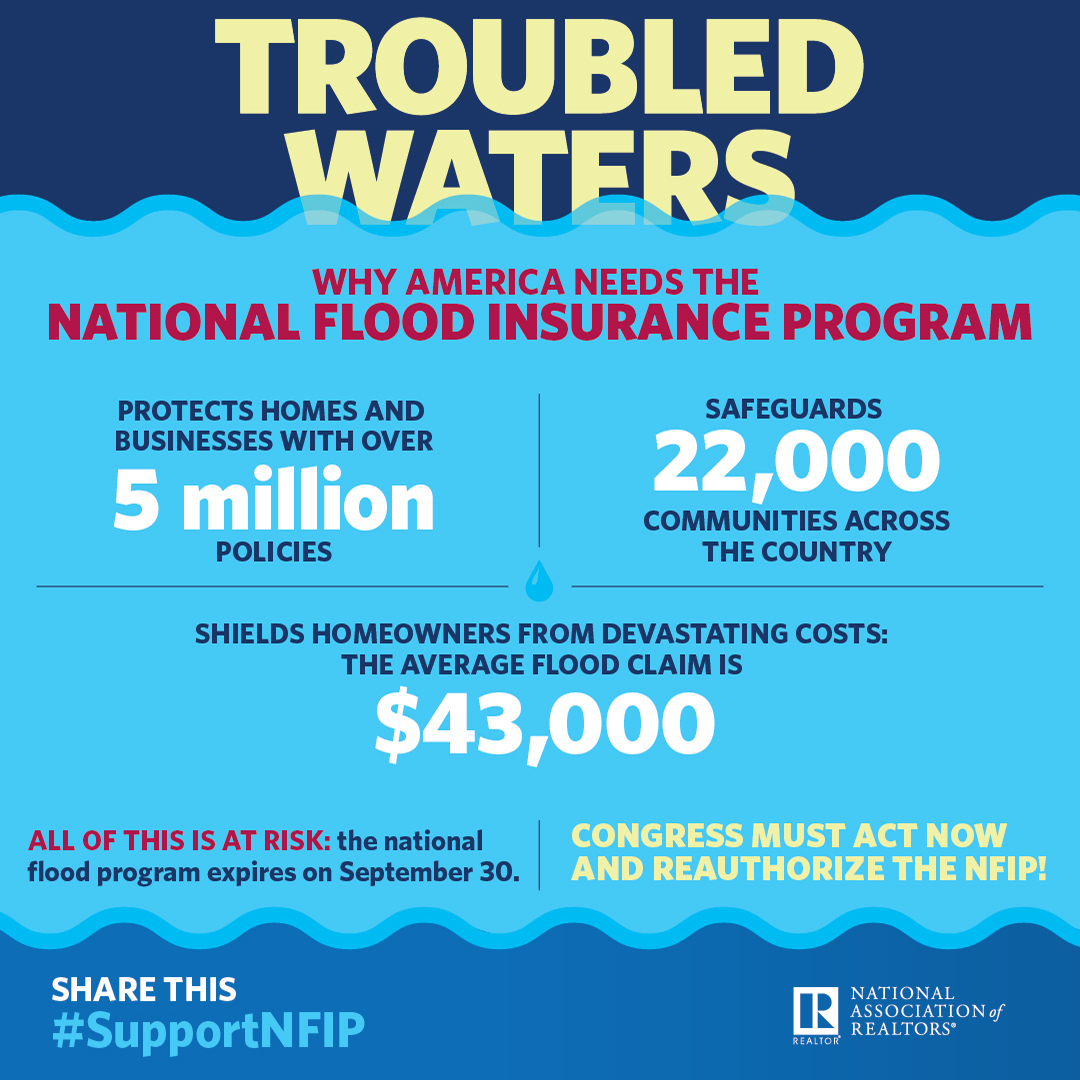

The infographic below from NAR shows why America needs the National Flood Insurance Program.

Click to enlarge

(Source: NAR)