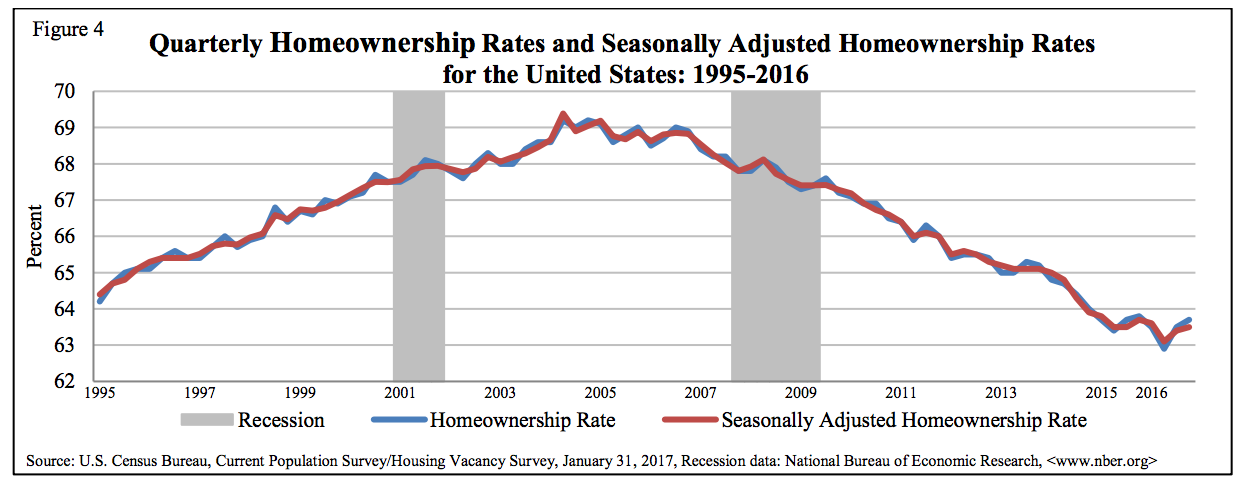

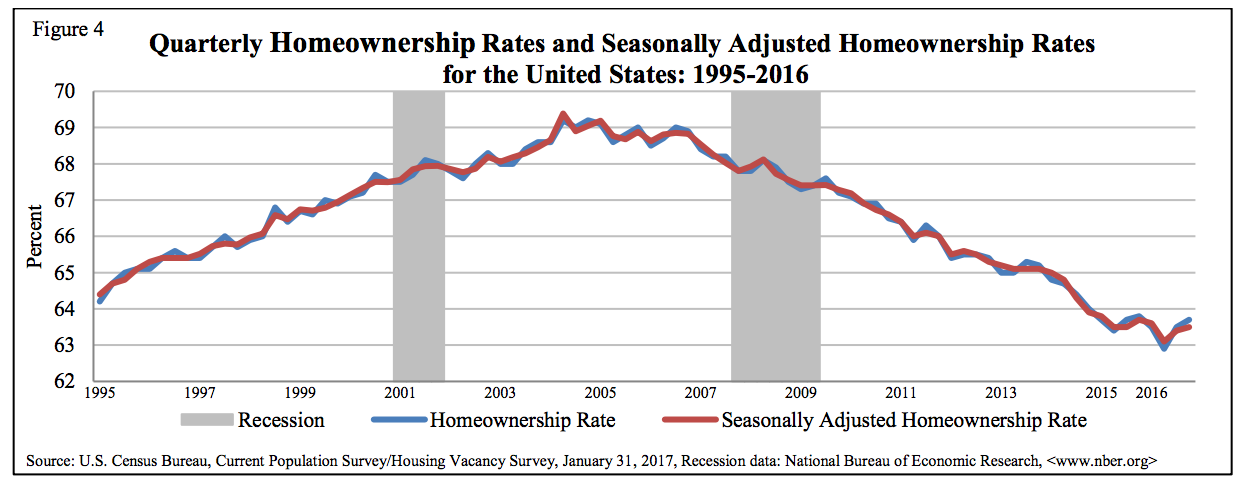

The homeownership rate remained the same in the fourth quarter as the previous year and the previous quarter, according to today’s report from the U.S. Census Bureau.

The national homeownership rate slipped only slightly to 63.7% in the fourth quarter. This is down from the previous year’s 63.8% and up slightly from the third quarter’s 63.5%.

Click to Enlarge

(Source: U.S. Census Bureau)

One economist explains that the lack of inventory is partially to blame for the low homeownership rate.

“After reaching a 50-year low in mid-2016, the homeownership rate edged up for the second consecutive time in the final quarter,” Capital Economics Property Economist Matthew Pointon said. “A lack of inventory is preventing a faster rebound in homeownership.”

The national vacancy rates for rental housing in the fourth quarter of 2016 dipped slightly from 7% in the fourth quarter of 2015 to 6.9%. This is a slight increase from the third quarter’s 6.8%. Similarly, the homeowner vacancy rate of 1.8% is also slightly down from the fourth quarter of 2015’s 1.9% and the same as the third quarter’s rate.

But this could get even worse in the year ahead. Trulia’s end of the year survey shows the share of Americans who say homeownership is part of the American dream dropped for the first time in five years from 75% last year to 72%.

This drop was even more extreme among Millennials. While in 2015 80% of Millennials said buying a home was part of the American dream, the survey at the end of 2016 showed that number dropped to 72%, now even with everyone else.

“Given millennials make up the largest pool of potential homebuyers in the U.S., this should be at least somewhat disconcerting,” Trulia Chief Economist Ralph McLaughlin said. “If the for-sale housing market is to continue building steam in the years ahead, this demographic will need to transition into homeownership in order to support the resale of homes by their older counterparts.”

“Though home buying among millennials is likely to be volatile in the short-run, the long-run potential for this generation to support housing consumption in the U.S. is large,” McLaughlin said.

However, there is still hope for the future of homeownership. McLaughlin points out that the report shows growth in household formation. Household formation increased 0.5%to 805,000 new households, however the increase was due to the formation of renter households.

“This effectively is why the homeownership rate has dropped: a greater share of new households since 2006 have been renters rather than home owners,” McLaughlin said. “But the margin is slimming: about 46% of new households over the past year were owner occupied.”