HousingWire loves technical advances.

Indeed, automation and innovation drive the HousingWire Tech100 awards. So yes, a future of efficiency and accuracy will only be aided by improving and increasing the power of our smartphones and other personal and professional devices.

But could all of this advancement come with a much darker side?

According to a website, called Will Robots Take My Job?, developed by Mubashar Iqbal and designed by Dimitar Raykov, robots will indeed take over. By some estimations, millions of jobs are at risk across the nation.

[h/t: Geek.com]

And this appears especially true for many mortgage and real estate jobs.

But, not everyone is buying the results.

“Most people want and need the reassurance and expertise of a professional human,” said Jeff Johnston, a North Texas real estate agent at eXp Realty.

“I don’t see how they can handle inspections, repair negotiations, appraisal negotiations, etc. on either side of the transaction. I find my role in the ‘deal’ is mostly negotiator and counselor,” he added. “I may be wrong, but I think as long as humans buy and sell homes, most buyers and sellers will prefer another human is involved to get the deal to the finish line.”

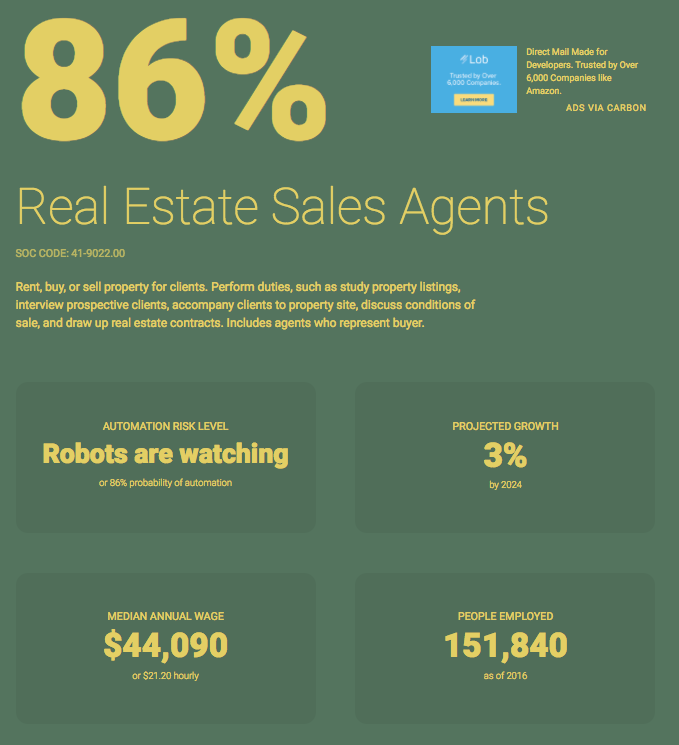

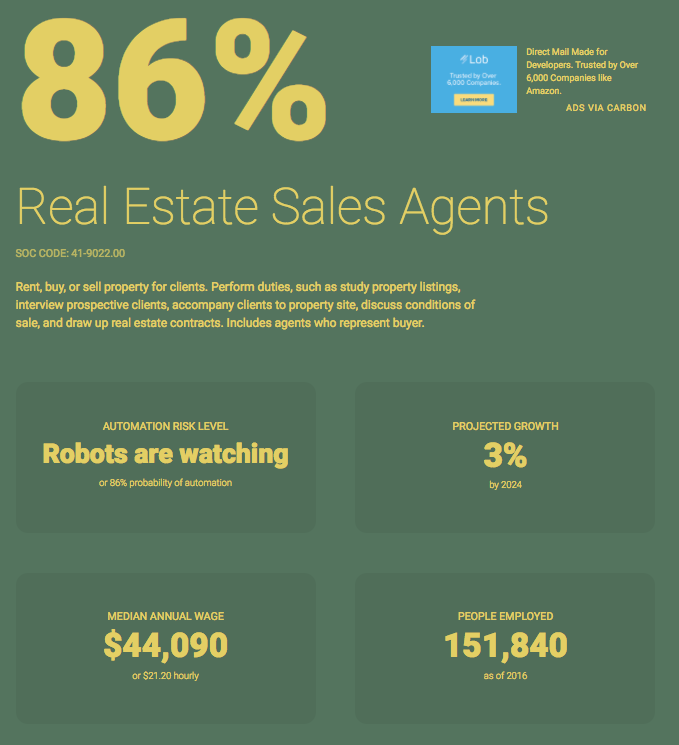

The Will Robots Take My Job? site compiles research on the future automation of jobs and provides a quick and searchable database. Search results reveal the likelihood of robots replacing occupations given as a percentage, with 100% being extremely likely.

For real estate agents, such as Johnston, appraisers and loan officers, the website paints a bleak future for job prospects. And, I’m with Johnston here, because when you add it all up, we’re talking more than half a million people are employed in the three following housing finance jobs. There’s no way robots can replace that many people. Or can they?

[Click the below images to enlarge.]

Here’s what it says about real estate agents:

Here’s what it says about appraisers:

Here’s what is says about loan officers:

Jacob Gaffney is the Editor-in-Chief of HousingWire and HousingWire.com. He previously covered securitization for Reuters and Source Media in London before returning to the United States in 2009. While in Europe for nearly a decade, he covered bank loans and the high yield market, in addition to commercial paper, student loan, auto and credit card space(s). At HousingWire, he began focusing his journalism on all aspects of the housing and mortgage markets.